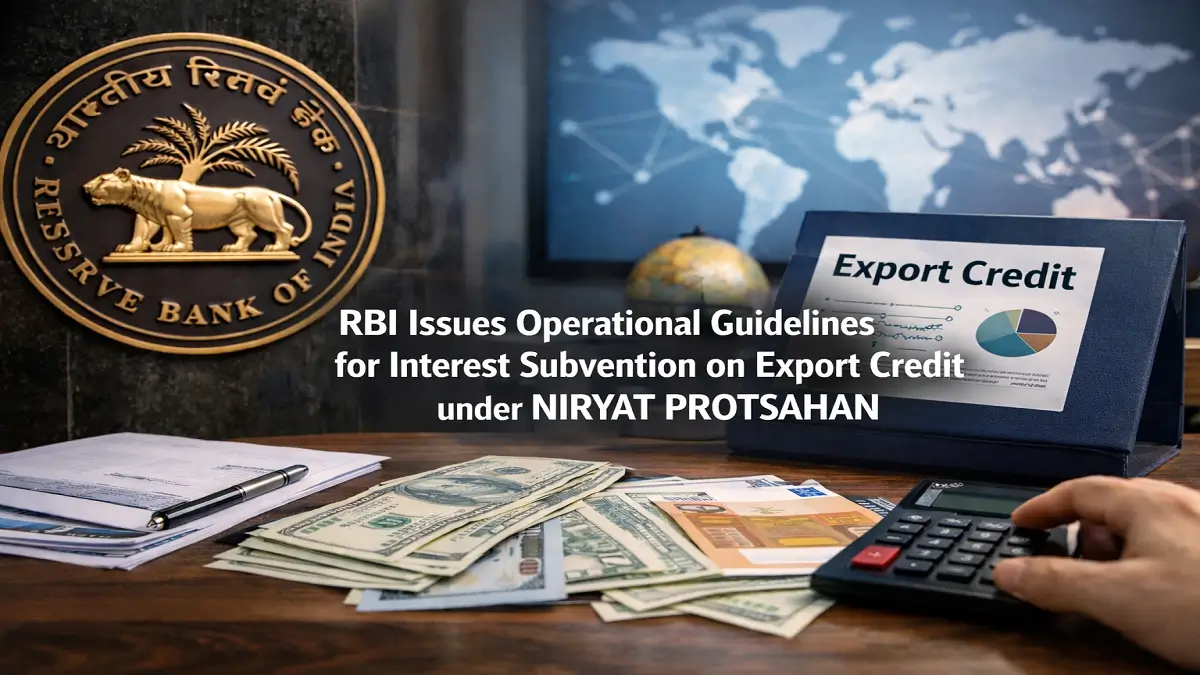

Wage and pension revision for PSGICs, NABARD, and RBI approved by GoI in 2026. Key pay hikes, NPS contributions, and benefits for employees and pensioners explained for exam preparation.

Government of India Approves Wage and Pension Revision for PSGICs, NABARD and RBI

New Delhi, January 23, 2026 – The Government of India (GoI) has approved a significant wage revision and pension enhancement package for employees and pensioners of key financial institutions such as Public Sector General Insurance Companies (PSGICs), National Bank for Agriculture and Rural Development (NABARD) and Reserve Bank of India (RBI). This major policy decision is aimed at improving compensation, ensuring social security, addressing inflation impacts, and strengthening the livelihood of both serving employees and retirees across these organisations.

Wage Revision for PSGIC Employees

The GoI has sanctioned a wage revision for employees of Public Sector General Insurance Companies (PSGICs) which includes National Insurance Company Ltd., New India Assurance Company Ltd., Oriental Insurance Company Ltd., United India Insurance Company Ltd., General Insurance Corporation of India and Agricultural Insurance Company Ltd.

Key Features:

- Effective Date: Wages revised from 1 August 2022

- Wage Hike: Approximately 12.41% increase in total wage bill along with 14% raise in basic pay and dearness allowance.

- National Pension System (NPS) Contribution: For employees who joined after April 1, 2010, employer NPS contribution raised from 10% to 14%.

- Family Pension Revision: Uniform family pension rate of 30% for beneficiaries.

This wage revision is expected to benefit over 43,000 PSGIC employees and enhance their retirement security and living standards.

NABARD Pay and Pension Revision

The Central Government has also sanctioned pay and pension revisions for NABARD employees and retirees.

Pay Revision Details:

- Effective From: 1 November 2022

- Pay Hike: Nearly 20% increase in basic pay and allowances for Group A, B, and C staff.

- Beneficiaries: Approx 3,800 serving and former employees.

Pension Parity:

Pension and family pension for NABARD retirees (who retired before Nov 1, 2017) have been brought at par with ex‑RBI NABARD retirees, correcting longstanding discrepancies.

RBI Pension Revision: A Major Boost for Retirees

In a landmark decision, the GoI approved pension and family pension enhancement for Reserve Bank of India (RBI) retirees.

Pension Enhancement Features:

- Effective Date: From 1 November 2022

- Hike: 10% increase on basic pension plus dearness relief — translating to an effective 1.43 times increase in basic pension.

- Beneficiaries: Over 30,000 pensioners and family pensioners.

This revision ensures enhanced financial stability for RBI retirees and supports better post‑retirement quality of life amid rising living costs.

Financial Implications and Overall Benefits

The total financial implications of these government measures are substantial:

- PSGIC Wage & Pension Revisions: Over ₹8,170 crore (wage arrears, NPS contributions, and pension enhancements).

- NABARD Pay & Pension Changes: Around ₹510 crore in arrears and additional wage increments.

- RBI Pension Revision: Nearly ₹2,697 crore, including arrears and recurring pension outgo.

In total, more than 46,000 employees, 23,500+ pensioners, and 23,000+ family pensioners stand to gain from this comprehensive package.

Why this News is Important for Exam Aspirants

Relevance in Competitive Exams

This government notification holds high relevance for candidates preparing for:

- Banking and Insurance Exams: (IBPS, SBI, RBIGradeB, NICL AO)

- Railway and SSC Exams: GK on government welfare measures and financial policies

- UPSC/State PSC: GS Paper II (Governance and Economic policies) & GS Paper III (Labour and Social Welfare)

- Defence and Teaching: General Awareness syllabus

Understanding policy revisions such as wage structures, pension reforms, and social security mechanisms helps aspirants answer static and current affairs questions with context and clarity.

Macro‑Economic Impact

These revisions also reflect the government’s intention to strengthen public sector financial institutions and ensure better retirement security. This is integral for questions related to economic reforms and labour welfare in exams.

Historical Context: Public Sector Compensation Reforms

Since independence, India’s public sector compensation and pension structures have evolved through periodic revisions like the Central Pay Commissions (CPCs) and Joint Consultative Machinery (JCM) settlements. Wage and pension revisions for financial sector employees like those of RBI and NABARD reflect this legacy of ensuring better social security, compensation parity, and employee welfare. Earlier revisions were often influenced by broader economic changes, inflation trends, and trade union negotiations. Recent reforms aim to align benefits with economic growth realities and inflation challenges, sustaining morale in crucial institutions that drive India’s financial stability and rural development.

🧠 Key Takeaways from “GoI Approves Wage and Pension Revision for PSGICs, NABARD and RBI”

| S. No. | Key Takeaway |

|---|---|

| 1 | GoI approved wage revisions for PSGICs effective from 1 August 2022. |

| 2 | NABARD staff will receive nearly 20% pay hike from 1 November 2022. |

| 3 | RBI pension and family pension increased by 10% on basic + DA. |

| 4 | NPS employer contribution for PSGIC employees raised from 10% to 14%. |

| 5 | Over 46,000 employees and 46,000+ pensioners/family pensioners will benefit. |

FAQs: Frequently Asked Questions

1. What is the recent wage revision approved by the Government of India?

The GoI approved wage revisions for employees of PSGICs, NABARD, and pension enhancements for RBI retirees. PSGIC employees received a wage hike effective from August 1, 2022, while NABARD staff received pay revisions from November 1, 2022.

2. How much is the increase in basic pay for PSGIC employees?

PSGIC employees received a 14% increase in basic pay and dearness allowance.

3. Who will benefit from the RBI pension revision?

Over 30,000 RBI pensioners and family pensioners will benefit from a 10% increase in basic pension plus dearness relief.

4. What is the change in employer contribution to NPS for PSGIC employees?

The employer contribution to the National Pension System (NPS) for PSGIC employees joining after April 1, 2010, has been raised from 10% to 14%.

5. Why is this news important for competitive exam aspirants?

This news is relevant for Banking, SSC, Railways, Defence, UPSC/PSC, and Teaching exams, as it covers public sector employee welfare, economic reforms, and government financial policies.

6. How many employees and pensioners are expected to benefit from these revisions?

More than 46,000 employees and over 46,000 pensioners/family pensioners will benefit from this wage and pension revision package.

Some Important Current Affairs Links