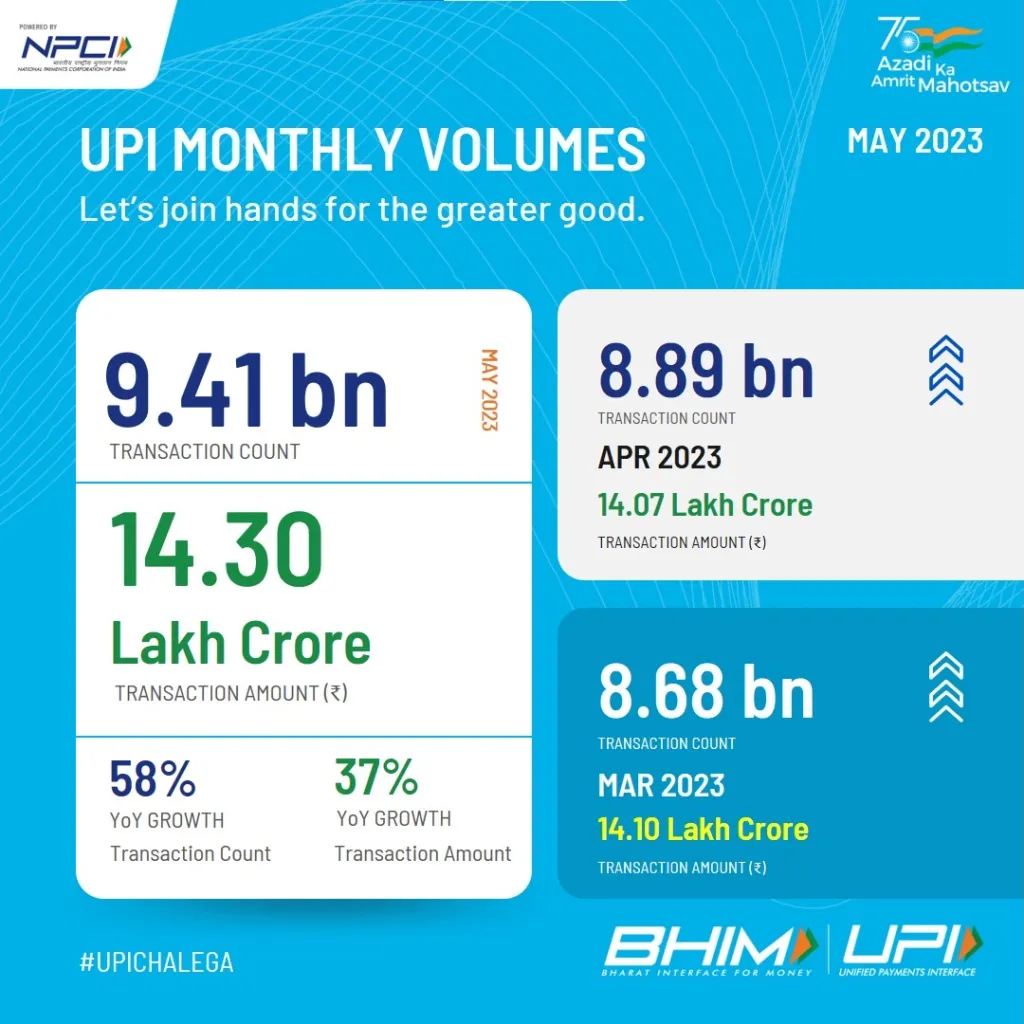

UPI Transactions Reach Record High of Rs. 14.3 Trillion in May 2023

The world of digital transactions witnessed a remarkable milestone in May 2023 as Unified Payments Interface (UPI) transactions in India soared to an all-time high. According to recent reports, UPI transactions reached an unprecedented record of Rs. 14.3 trillion during this period, showcasing the exponential growth and acceptance of digital payments in the country. This article delves into the significance of this news, provides a historical context, and highlights five key takeaways for students preparing for government exams.

Why this News is Important:

Boost to Digital India Initiative:

With UPI transactions scaling new heights, this achievement underlines the success of the Digital India initiative. It showcases the positive impact of government policies and technological advancements in driving financial inclusion and digital adoption across the country. Such progress aligns with the government’s vision of creating a less-cash economy.

Convenient and Secure Payment Method:

The surge in UPI transactions reflects the growing trust of individuals and businesses in digital payment systems. UPI offers a seamless and secure platform for peer-to-peer transactions, making it an attractive choice for users. This news emphasizes the convenience and reliability of UPI as a payment method, which can be beneficial for students appearing in exams related to banking and finance sectors.

Implications for the Economy:

The increasing reliance on digital transactions has far-reaching implications for the Indian economy. It contributes to a reduction in cash transactions, which in turn combats issues like corruption, tax evasion, and counterfeit currency. Moreover, the surge in UPI transactions stimulates economic growth by streamlining payment processes, enhancing transparency, and boosting financial inclusion.

Job Opportunities:

The rise of UPI transactions also opens up new avenues for job opportunities in the financial technology sector. As the demand for digital payment solutions increases, so does the need for skilled professionals who can develop, manage, and secure these platforms. This news can serve as a valuable insight for students aspiring to join the banking and technology sectors.

Historical Context:

To comprehend the significance of UPI transactions reaching a record high, it is essential to consider the historical context. The Unified Payments Interface was launched in 2016 by the National Payments Corporation of India (NPCI). It revolutionized the digital payment landscape by enabling instant fund transfers and allowing users to link multiple bank accounts through a single mobile application. Since its inception, UPI has witnessed exponential growth, transforming the way people transact in India.

Key Takeaways from “UPI Transactions Reach Record High of Rs. 14.3 Trillion in May 2023”:

| Takeaway | Key Takeaway |

|---|---|

| 1. | UPI transactions in May 2023 surged to an all-time high of Rs. 14.3 trillion, indicating the widespread adoption of digital payments in India. |

| 2. | The achievement showcases the success of the Digital India initiative and the government’s efforts towards creating a less-cash economy. |

| 3. | UPI provides a secure and convenient payment platform, enhancing financial inclusion and transparency in transactions. |

| 4. | The rise of UPI transactions offers new job opportunities in the financial technology sector, emphasizing the need for skilled professionals. |

| 5. | Understanding the impact of UPI transactions is important for students preparing for government exams, especially in banking and finance-related fields. |

Conclusion

In conclusion, the remarkable surge in UPI transactions to a record high of Rs. 14.3 trillion in May 2023 highlights the growing acceptance and convenience of digital payments in India. This achievement is a testament to the success of the Digital India initiative, and it holds relevance for students preparing for government exams, especially in fields related to banking and finance. Understanding the historical context, implications, and key takeaways from this news can provide valuable insights for exam preparation.

Important FAQs for Students from this News

Q: What is UPI, and how does it work?

A: UPI stands for Unified Payments Interface, which is a real-time payment system in India that allows users to link multiple bank accounts and make instant fund transfers through a mobile application.

Q: What are the advantages of UPI transactions?

A: UPI transactions offer several advantages, including convenience, security, instant transfer of funds, 24/7 availability, and the ability to link multiple bank accounts.

Q: How does the surge in UPI transactions impact the Indian economy?

A: The increase in UPI transactions positively impacts the Indian economy by reducing cash transactions, combating corruption and tax evasion, enhancing transparency, and promoting financial inclusion.

Q: What job opportunities are created by the rise in UPI transactions?

A: The surge in UPI transactions creates job opportunities in the financial technology sector, including roles in developing and managing digital payment platforms, ensuring security, and driving innovation.

Q: How can knowledge of UPI transactions be relevant for government exams?

A: Understanding UPI transactions is relevant for exams related to banking, civil services, and other government positions, as it reflects the progress of the Digital India initiative, financial inclusion efforts, and the impact of digital payments on the economy.

Some Important Current Affairs Links