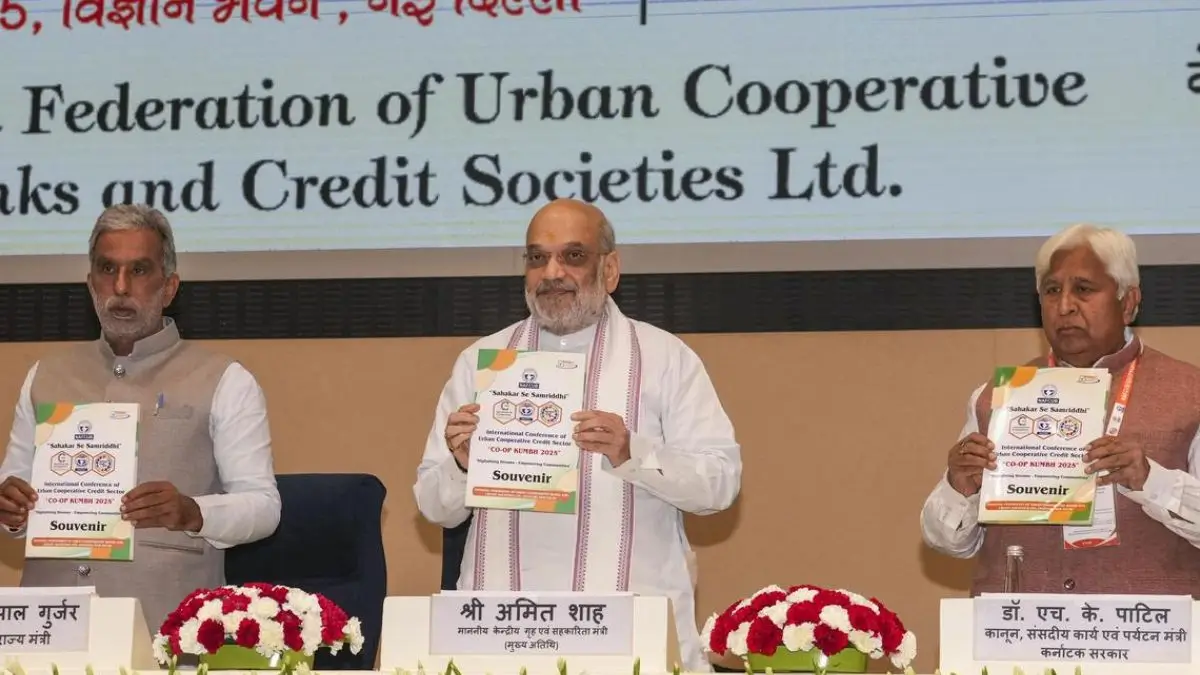

Digital banking reforms in India gain momentum as Amit Shah launches Sahakar Digi Pay and Sahakar Digi Loan apps for urban cooperative banks, promoting financial inclusion and digital payments.

Amit Shah launches digital apps for urban co‑op banks

Modernising cooperative banking for enhanced reach

On 10 November 2025, Amit Shah, Union Cooperation Minister, inaugurated two digital applications — Sahakar Digi Pay and Sahakar Digi Loan — aimed at catalysing the digital‑transformation of urban cooperative banks (UCBs). hese apps are designed to enable seamless payments and streamlined digital lending, respectively, for customers of urban cooperative banks across India. The launch coincided with a two‑day international conference on the urban cooperative credit sector, where the minister also announced ambitious targets for expansion and modernization of UCBs.

Digital transformation of urban cooperative banks

In his address, the minister emphasised the growing need for cooperative banks to adopt modern technologies in order to stay competitive in the era of a cashless economy. The Sahakar Digi Pay app will allow UCB customers to make digital payments efficiently, while the Sahakar Digi Loan app will facilitate easier access to credit for individuals and small businesses.The government has set a target to onboard around 1,500 urban cooperative banks to the digital platform within two years.

Growth and expansion targets for the sector

Further to digital adoption, the minister announced that the goal is to establish at least one urban cooperative bank in every town with a population of over two lakh within the next five years.The strategy includes converting successful cooperative credit societies into urban cooperative banks to widen coverage and increase accessibility of financial services. Priority will also be given to providing support to young entrepreneurs and economically disadvantaged groups.

Sector reforms and achievements so far

The urban cooperative banking sector has seen significant progress in recent years. The non‑performing assets (NPAs) of UCBs have declined impressively — from 2.8 % to 0.6% over the past two years.In addition, model bylaws for Primary Agricultural Credit Societies (PACS) have been adopted nationally, and computerisation as well as expansion of cooperative banking services have been encouraged under the central government’s guidance.

Challenges and calls for action

Despite the encouraging developments, the sector still faces challenges. Around 20 urban cooperative banks are reportedly on the verge of closure, underscoring the need for strong governance, risk management, and digital reforms. While cooperation is primarily a state subject, the central government is playing a role in offering policy guidance for uniformity and sector growth. The minister underscored the need for UCBs to adopt strategies akin to successful bank turnarounds to ensure sustainability.

Why This News Is Important

For banking and financial services aspirants

This development is highly significant for students preparing for banking, railways, defence finance & civil service exams because it highlights the government’s push to modernise a crucial segment of India’s banking system — the urban cooperative banks. Digitalisation of UCBs means new technology use, regulatory changes and financial‑inclusion efforts — all of which may find mention in exam syllabi under topics like banking reforms, digital payments, financial inclusion and cooperative credit structures.

Institutional and structural importance

By launching Sahakar Digi Pay and Sahakar Digi Loan, the government is signalling a renewed institutional focus on cooperative banks. The growth targets (1 UCB per town over 2 lakh population) indicate structural reform, expansion of banking access, and inclusion of underserved areas. For civil services and competitive exam aspirants, the news underlines how policy measures translate into reform initiatives, and the kind of sectoral targets and achievements to be aware of.

Implications for policy and exam‑relevant themes

The reduction in NPAs, adoption of bylaws for PACS, and the conversion of credit societies into UCBs connect to broader themes such as financial stability, regulatory oversight, digital adoption in banking and cooperative sector reform. These are topics frequently tested in banking exams (e.g., RBI regulation or cooperative banking) and civil services GS papers (economy / banking & finance). Students should take note of how the cooperative banking sector is evolving, the digital impetus behind it, and the government’s ambitions going ahead.

Historical Context

The cooperative banking sector in India has a long history, with roots in the early 20th century when cooperative credit societies were established to provide credit to farmers and small businesses. Over decades, urban cooperative banks emerged to serve urban and semi‑urban populations, with regulatory oversight from both the state governments and the Reserve Bank of India (RBI).

In recent years, the landscape has been challenging — issues such as weak governance, high NPAs, lack of technology adoption and limited reach have hampered many UCBs. Initiatives like the “Vision 2030” for cooperative banking, computerisation drives and adoption of model bylaws for PACS sought to strengthen the sector. The launch of these digital apps by the Cooperation Minister continues this reform trajectory, leveraging the growth of digital payments and lending platforms in India’s broader push towards a cash‑lite economy.

The government’s emphasis on financial inclusion, support for micro, small and medium enterprises (MSMEs), and leveraging technology (for example through the Digital India campaign) provide the backdrop against which this news must be viewed. Thus, the announcement represents not just a standalone initiative but part of a larger structural reform in India’s cooperative banking sector.

Key Takeaways from “Launch of Digital Apps for Urban Cooperative Banks”

| S. No | Key Takeaway |

|---|---|

| 1 | Two digital apps — Sahakar Digi Pay (for payments) and Sahakar Digi Loan (for lending) — were launched by the Cooperation Minister. |

| 2 | Target to onboard around 1,500 urban cooperative banks onto the digital platform within two years. |

| 3 | The objective includes establishing at least one urban cooperative bank in every town with population over 2 lakh within five years. |

| 4 | NPAs in the UCB sector have been reduced significantly from 2.8% to 0.6% over the past two years. |

| 5 | The reform initiative is part of the government’s broader agenda of digital banking, financial inclusion and strengthening cooperative credit institutions. |

FAQs: Frequently Asked Questions

1. What digital apps were launched for urban cooperative banks?

Two apps — Sahakar Digi Pay for digital payments and Sahakar Digi Loan for digital lending — were launched to modernize urban cooperative banks.

2. Who launched the Sahakar Digi apps?

Union Cooperation Minister Amit Shah launched the apps during an international conference on urban cooperative credit.

3. What is the target for digital onboarding of urban cooperative banks?

The government aims to onboard 1,500 urban cooperative banks onto the digital platform within the next two years.

4. What is the government’s target for urban cooperative banks in towns?

The goal is to establish at least one urban cooperative bank in every town with a population over 2 lakh within five years.

5. How have NPAs in urban cooperative banks changed recently?

Non-Performing Assets (NPAs) in UCBs have reduced from 2.8% to 0.6% in the past two years, indicating improved financial health.

6. Why are these digital apps significant for cooperative banking?

They enhance digital payments, streamline lending, promote financial inclusion, and modernize banking infrastructure in urban cooperative banks.

7. How do these initiatives benefit exam aspirants?

This news is important for banking, civil services, and competitive exams because it covers topics like digital banking reforms, cooperative banking, financial inclusion, and government initiatives.

8. Are cooperative banks regulated by the government?

Yes, urban cooperative banks are regulated by the Reserve Bank of India (RBI) and state governments, with policy guidance from the central government.

9. What challenges still exist in urban cooperative banks?

Some UCBs face governance issues, risk of closure, lack of digital adoption, and limited outreach, requiring reforms.

10. How does this initiative align with India’s digital economy goals?

It supports the Digital India mission, promotes cashless transactions, and integrates cooperative banks into modern financial technology ecosystems.

Some Important Current Affairs Links