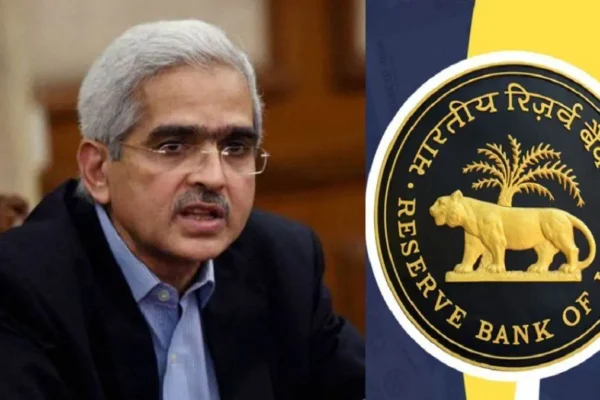

RBI’s Strategic Liquidity Infusion to Stabilize Money Markets in 2025 – Impact on Economy and Banking

RBI’s Strategic Liquidity Infusion to Stabilize Money Markets Introduction: RBI’s Strategic Move to Stabilize Money Markets On January 2025, the Reserve Bank of India (RBI) announced a significant step in its monetary policy with a strategic liquidity infusion aimed at stabilizing the money markets. This move comes in response to the recent volatility observed in…