GST Rate Rationalisation: Benefits, Impact, and Latest Updates

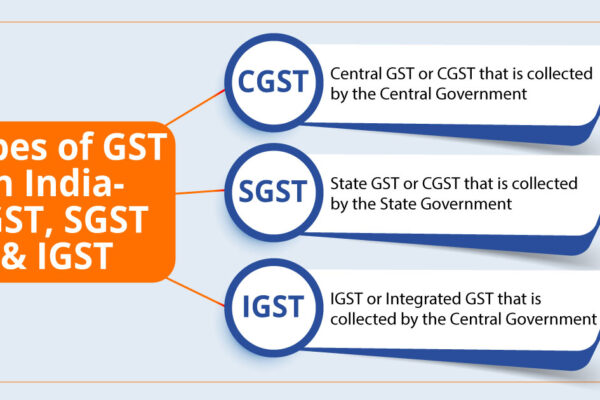

GST Rate Rationalisation After Item-wise Analysis In a significant move aimed at streamlining the Goods and Services Tax (GST) regime, the Government of India has initiated a thorough item-wise analysis to rationalize GST rates. This decision comes as part of ongoing efforts to simplify the tax structure and boost compliance across various sectors. The GST…