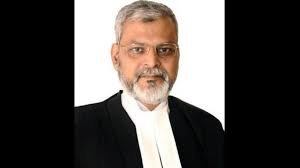

Sanjaya Kumar Mishra to Head GST Appellate Tribunal

Sanjaya Kumar Mishra, a seasoned bureaucrat, has been appointed as the head of the Goods and Services Tax (GST) Appellate Tribunal. This appointment comes at a crucial juncture as the GST regime undergoes various reforms and adjustments.

Background of the Appointment: The GST Appellate Tribunal plays a pivotal role in the indirect tax system of India. It serves as the appellate authority for disputes related to GST between taxpayers and the tax authorities. Mishra’s extensive experience in administrative roles makes him a suitable candidate for this position.

Mishra’s Profile: Sanjaya Kumar Mishra is an Indian Revenue Service (Customs and Central Excise) officer of the 1984 batch. He has held several important positions in the past, including Director-General of the Directorate General of Revenue Intelligence (DGRI) and Principal Chief Commissioner of Customs (Preventive), Kolkata Zone.

Implications of the Appointment: Mishra’s appointment is expected to bring efficiency and transparency to the functioning of the GST Appellate Tribunal. His vast experience in tax administration and dispute resolution will likely streamline the tribunal’s processes and enhance its effectiveness.

Conclusion: Sanjaya Kumar Mishra’s appointment as the head of the GST Appellate Tribunal is a significant development in India’s tax administration system. It reflects the government’s commitment to strengthening the GST framework and resolving disputes in a fair and timely manner.

Why this News is Important:

Appointment of Sanjaya Kumar Mishra: Sanjaya Kumar Mishra, a senior bureaucrat, has been appointed as the head of the Goods and Services Tax (GST) Appellate Tribunal. This appointment holds importance due to its potential impact on the efficiency and effectiveness of the GST dispute resolution mechanism.

Strengthening the GST Framework: The appointment of Mishra signifies the government’s efforts to strengthen the GST framework and ensure smooth functioning of the appellate process. Mishra’s extensive experience in tax administration is expected to bring much-needed expertise to the tribunal.

Enhancing Dispute Resolution: With Mishra at the helm, the GST Appellate Tribunal is likely to witness improvements in dispute resolution processes. His appointment is expected to streamline procedures and expedite the resolution of GST-related disputes, which is crucial for maintaining taxpayer trust and compliance.

Transparency and Accountability: Mishra’s appointment underscores the government’s commitment to transparency and accountability in the GST regime. His track record in administrative roles suggests a focus on fairness and impartiality, which are essential for building trust in the tax administration system.

Ensuring Taxpayer Confidence: A robust and efficient appellate mechanism is vital for ensuring taxpayer confidence in the GST system. Mishra’s appointment sends a positive signal to taxpayers regarding the government’s resolve to address their concerns and grievances in a timely and impartial manner.

Historical Context:

The establishment of the Goods and Services Tax (GST) regime in India marked a significant milestone in the country’s indirect tax system. Introduced in July 2017, GST aimed to streamline the taxation structure by subsuming various indirect taxes levied by the central and state governments.

One of the key components of the GST framework is the establishment of appellate authorities to adjudicate disputes between taxpayers and tax authorities. The GST Appellate Tribunal was set up to provide an independent forum for resolving disputes related to GST.

Over the years, the functioning of the GST Appellate Tribunal has been subject to scrutiny, with calls for reforms to enhance its efficiency and effectiveness. The appointment of experienced professionals like Sanjaya Kumar Mishra is part of the government’s efforts to address these concerns and strengthen the GST dispute resolution mechanism.

5 Key Takeaways from “Sanjaya Kumar Mishra to Head GST Appellate Tribunal”:

| Serial Number | Key Takeaway |

|---|---|

| 1. | Sanjaya Kumar Mishra has been appointed as the head of the GST Appellate Tribunal. |

| 2. | Mishra’s appointment is expected to bring efficiency and transparency to the functioning of the tribunal. |

| 3. | He brings extensive experience in tax administration and dispute resolution to the position. |

| 4. | Mishra’s appointment reflects the government’s commitment to strengthening the GST framework and resolving disputes effectively. |

| 5. | The appointment is crucial for enhancing taxpayer confidence in the GST system and ensuring fairness and impartiality in dispute resolution processes. |

Important FAQs for Students from this News

What is the GST Appellate Tribunal?

The GST Appellate Tribunal is an appellate authority established under the Goods and Services Tax (GST) regime to resolve disputes between taxpayers and tax authorities regarding GST issues.

Who is Sanjaya Kumar Mishra?

Sanjaya Kumar Mishra is a senior bureaucrat and an Indian Revenue Service (Customs and Central Excise) officer of the 1984 batch. He has held several important positions in the past, including Director-General of the Directorate General of Revenue Intelligence (DGRI) and Principal Chief Commissioner of Customs (Preventive), Kolkata Zone.

What is the significance of Mishra’s appointment?

Mishra’s appointment as the head of the GST Appellate Tribunal is significant as it is expected to bring efficiency, transparency, and expertise to the tribunal’s functioning. It reflects the government’s commitment to strengthening the GST framework and resolving disputes effectively.

How does the GST Appellate Tribunal contribute to the GST system?

The GST Appellate Tribunal serves as an independent forum for taxpayers to appeal against decisions of the tax authorities regarding GST issues. Its role is crucial in ensuring fairness and impartiality in the resolution of disputes and maintaining taxpayer confidence in the GST system.

What are the implications of Mishra’s appointment for taxpayers?

Mishra’s appointment is expected to streamline the dispute resolution process, expedite the resolution of GST-related disputes, and ensure transparency and accountability in the tax administration system. This, in turn, is likely to enhance taxpayer confidence and compliance with the GST regulations.

Some Important Current Affairs Links