RBI Transaction Account Guidelines 2025: Learn about new rules for current, overdraft, and collection accounts, minimum credit exposure limits, and cash credit reforms for businesses.

RBI Issues New Guidelines on Transaction Accounts Across Regulated Entities

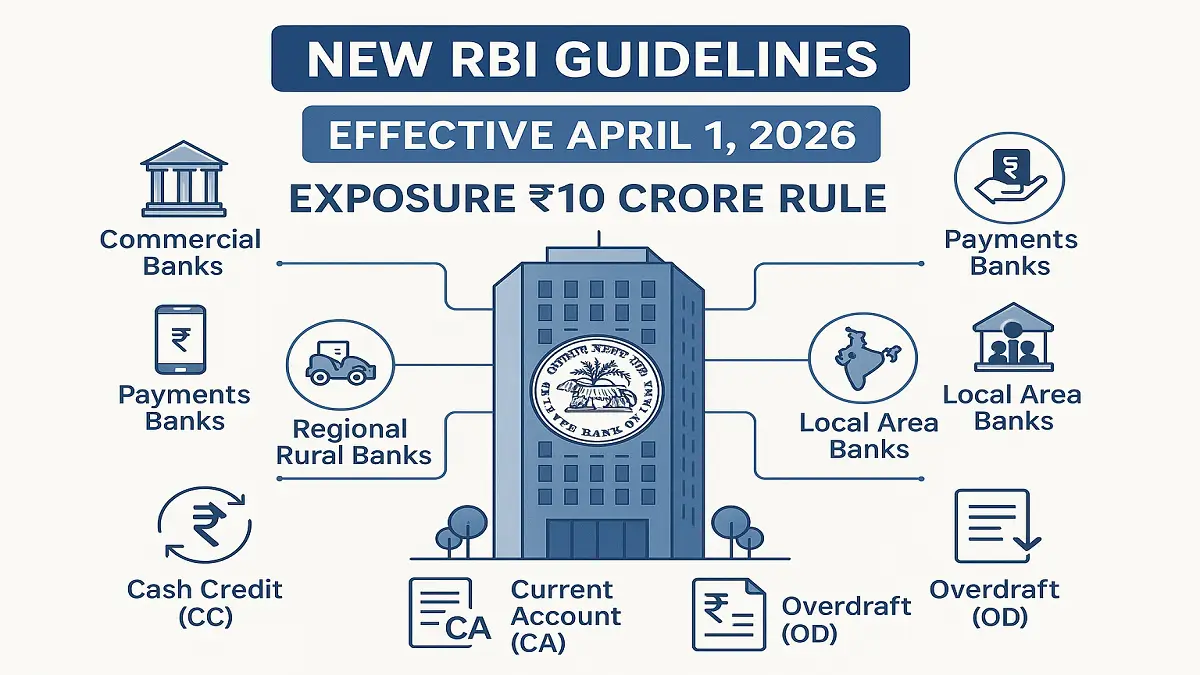

The Reserve Bank of India (RBI) has introduced comprehensive revised guidelines governing the opening, operation, and maintenance of transaction accounts such as current accounts, overdraft accounts, and collection accounts by regulated entities like commercial banks and NBFCs. These regulations, which will come into effect from April 1, 2026, are intended to improve credit discipline in the banking system and enhance operational flexibility for both lenders and borrowers.

Under the updated framework, banks are now allowed to open current or overdraft accounts for a borrower provided the bank’s total credit exposure to that borrower is at least 10% or more. Earlier, stricter limits restricted these accounts based on the borrower’s exposure level, which often made account opening complicated for many businesses. Additionally, if no bank meets this 10% threshold, the two lenders with the highest credit exposure may maintain essential transaction accounts for the borrower.

The RBI also clarified rules around collection accounts. These accounts are primarily used for receiving funds and must typically transfer money to the borrower’s designated transaction account within two working days. This ensures that funds aren’t retained unnecessarily, promoting better transparency and ease of monitoring. Key exemptions have also been provided — for example, accounts mandated under statute or regulatory requirements do not fall under these transaction limits.

Another critical reform is the removal of restrictions on cash credit accounts (CC). Recognizing feedback from the banking industry, RBI has allowed banks to open and operate CC accounts according to customer needs, without stringent caps or limits. This move is expected to provide greater flexibility in short‑term working capital financing for businesses and enhance the ease of doing business across sectors.

These guidelines also include monitoring and compliance provisions that require banks to review transactions and maintain accountability. For example, accounts must be properly flagged in banks’ core banking systems to ensure timely review and regulatory adherence

Why This News Is Important

Relevance to Banking and Financial Awareness:

The RBI’s guidelines on transaction accounts are a major regulatory reform in India’s banking sector, directly impacting how banks manage lending and current account operations. Current affairs questions in exams like IBPS PO, SBI PO/Clerk, RRB NTPC, SSC CGL, UPSC, and State PCS often focus on RBI policies that affect credit discipline and banking norms. These guidelines form part of the broader banking and economic regulations aspirants must know.

Impact on Businesses and Credit Monitoring:

For government exam students with questions on financial regulations, it’s essential to understand how RBI’s rules influence business lending, account operations, and credit management. These reforms ease procedural restrictions while ensuring that risks are adequately monitored — topics that regularly appear under economics, banking studies, and general awareness sections of competitive exams.

Connection with Broader Economic Policies:

This change aligns with RBI’s efforts to strengthen credit flow, promote transparency, and improve customer service in the financial sector. The move also reflects RBI’s strategy to balance financial stability with business ease — a recurring theme in exam questions on monetary and banking policy frameworks.

Understanding such policy shifts not only helps aspirants answer direct questions but also builds conceptual clarity around financial governance in India.

Historical Context: RBI Guidelines on Transaction Accounts

The RBI has periodically updated rules related to transaction accounts as part of its supervisory and regulatory framework for banks in India. Historically, current account opening rules were tightened to promote credit discipline, especially for borrowers with significant bank exposure. Under earlier norms, banks faced restrictions on opening current accounts for borrowers whose total credit exposure exceeded certain thresholds. These rules were intended to prevent misuse of current and overdraft accounts for credit facilities outside the supervisory framework.

However, feedback from the banking sector highlighted that excessive restrictions sometimes hindered routine business transactions and working capital needs. In response, RBI initiated revisions to balance the need for monitoring lender exposure while providing operational flexibility for businesses — especially small and medium enterprises. The 2025 guidelines reflect this evolution, re‑calibrating eligibility criteria based on exposure and revising rules for collection accounts and cash credit operations.

These reforms are also part of a larger series of updates by RBI in 2025 aimed at modernizing banking regulations, promoting financial inclusion, and enhancing regulatory clarity across all regulated entities.

Key Takeaways from RBI’s New Guidelines on Transaction Accounts

| # | Key Takeaway |

|---|---|

| 1. | RBI’s new guidelines govern the opening and operation of transaction accounts like current, overdraft, and collection accounts. |

| 2. | Any bank with at least 10% exposure to a borrower can open current or overdraft accounts under the revised rules. |

| 3. | If no lender meets the 10% threshold, the two banks with the highest exposure can maintain such accounts. |

| 4. | Restrictions on cash credit (CC) accounts have been removed, giving banks more flexibility to offer working capital credit. |

| 5. | Collection accounts must transfer funds to designated accounts within two working days, improving transparency and fund monitoring. |

FAQs: RBI Issues New Guidelines on Transaction Accounts

Which exams can include questions about these RBI guidelines?

Exams like IBPS PO/Clerk, SBI PO, RRB NTPC, SSC CGL, UPSC, State PCS, and other government recruitment exams often include banking and financial regulation topics.

What are transaction accounts according to RBI guidelines?

Transaction accounts include current accounts, overdraft accounts, and collection accounts, which are used for day-to-day business operations and fund transfers.

When will the new RBI guidelines on transaction accounts come into effect?

The guidelines are effective from April 1, 2026, allowing banks to operate accounts under the revised norms.

What is the minimum credit exposure required for a bank to open a current account for a borrower?

A bank must have at least 10% of total credit exposure to the borrower to open a current or overdraft account.

What happens if no bank meets the 10% exposure threshold for a borrower?

In such cases, the two banks with the highest credit exposure are allowed to maintain transaction accounts for the borrower.

Are there any changes regarding cash credit (CC) accounts?

Yes, the RBI has removed restrictions on CC accounts, providing banks more flexibility in offering working capital facilities.

What are collection accounts and what is their primary function?

Collection accounts are used to receive funds on behalf of borrowers and transfer them to the designated transaction account, typically within two working days.

Do statutory or regulatory accounts come under these new transaction account limits?

No, accounts mandated by statute or regulatory requirements are exempted from these limits.

How will the guidelines affect business credit and operations?

The guidelines are expected to ease credit access, improve transparency, and enhance operational flexibility for businesses.

Why did RBI revise transaction account guidelines?

The revisions were made to balance credit discipline with ease of business, addressing concerns raised by banks about operational challenges under the earlier rules.

Some Important Current Affairs Links