India’s Fiscal Update 2023-24: Deficit and Revenue Surge

In the fiscal year 2023-24, India witnessed significant developments in its fiscal landscape, marked by a notable surge in both deficit and revenue. This fiscal update holds paramount importance for aspirants preparing for various government exams, including those aspiring for positions in teaching, police services, banking, railways, defense, and civil services like PSCS to IAS. Understanding these fiscal dynamics is crucial as it reflects the economic health of the country and often forms a significant portion of exam syllabi.

Introduction:

The fiscal year 2023-24 brought forth several challenges and opportunities for India’s economy, with fiscal management taking center stage amidst the backdrop of a recovering post-pandemic scenario.

Deficit Surge:

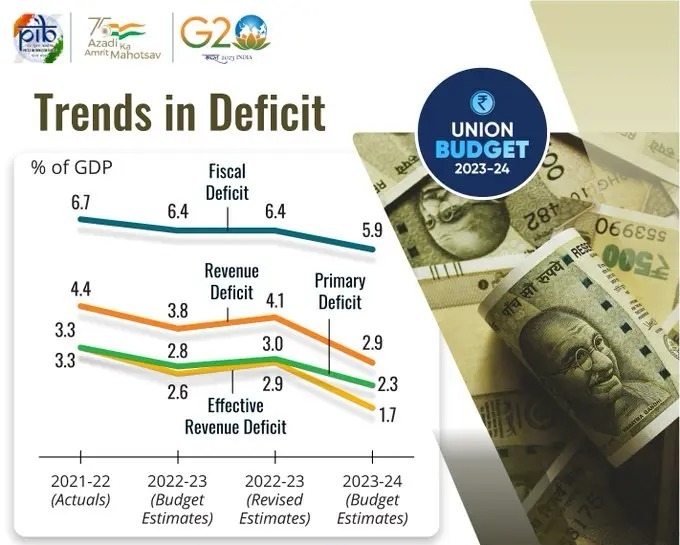

One of the most striking features of India’s fiscal update for 2023-24 is the surge in the fiscal deficit. This deficit, representing the shortfall in the government’s total expenditure compared to its total revenue, has widened significantly compared to previous years.

Revenue Growth:

Despite the widening deficit, the fiscal update also highlights a substantial surge in revenue. This surge is attributed to various factors, including improved tax collection mechanisms, increased economic activity, and policy measures aimed at boosting revenue streams.

Spending Priorities:

Amidst the fiscal challenges, the government has outlined its spending priorities, focusing on key sectors such as infrastructure, healthcare, education, and defense. Understanding these spending priorities is crucial for aspirants as they reflect the government’s policy direction and areas of emphasis.

Policy Implications:

The fiscal update for 2023-24 has significant policy implications, shaping government policies related to taxation, expenditure, and fiscal management. Aspirants need to grasp these implications to comprehend the broader economic context within which government decisions are made.

Conclusion:

In conclusion, India’s fiscal update for 2023-24 reflects a mix of challenges and opportunities, with a notable surge in deficit and revenue. Aspirants preparing for government exams must familiarize themselves with these fiscal dynamics to enhance their understanding of economic policies and their implications on governance and public administration.

Why this News is important:

Significance of Fiscal Update:

The fiscal update for India in the year 2023-24 holds immense importance for aspirants preparing for various government exams due to its direct relevance to topics such as economics, governance, and public administration.

Understanding Economic Health:

Analyzing the fiscal deficit and revenue surge provides insights into the economic health of the country, a crucial aspect for aspirants aiming for positions in civil services, banking, and other government sectors.

Policy Implications for Governance:

The fiscal dynamics outlined in the update have significant policy implications, shaping government decisions related to taxation, expenditure, and fiscal management, topics often covered in government exam syllabi.

Reflection of Government Priorities:

The spending priorities highlighted in the fiscal update reflect the government’s focus areas, offering aspirants valuable insights into the policy direction and areas of emphasis in governance.

Relevance to Exam Syllabi:

Understanding India’s fiscal update is directly relevant to exam syllabi for government exams, providing aspirants with current affairs knowledge essential for exam preparation.

Historical Context:

Background:

India’s fiscal landscape has witnessed fluctuations over the years, influenced by both domestic and global economic factors. Understanding the historical context provides a deeper insight into the current fiscal dynamics of the country.

Previous Fiscal Trends:

Previous fiscal years have seen varying levels of deficit and revenue, influenced by factors such as economic growth, policy measures, and global economic conditions.

Policy Interventions:

Historically, governments have implemented various policy interventions to manage fiscal deficits and enhance revenue streams, shaping the fiscal landscape of the country over time.

Global Economic Impact:

India’s fiscal performance is also impacted by global economic trends, including changes in commodity prices, international trade dynamics, and geopolitical developments.

Policy Continuity and Change:

Analyzing historical fiscal trends highlights patterns of policy continuity and change, offering insights into the evolution of economic policies and governance frameworks over time.

Key Takeaways from “India’s Fiscal Update 2023-24”:

| Serial Number | Key Takeaway |

|---|---|

| 1. | Surge in fiscal deficit indicates fiscal challenges |

| 2. | Revenue growth reflects economic recovery |

| 3. | Government spending priorities focus on key sectors |

| 4. | Policy implications shape governance decisions |

| 5. | Understanding fiscal dynamics is crucial for exams |

Important FAQs for Students from this News

1. What is a fiscal deficit, and why is it important?

- A fiscal deficit occurs when a government’s total expenditures exceed its total revenue. It’s important as it reflects the government’s borrowing requirements and can impact economic stability.

2. How does the surge in revenue benefit the economy?

- A surge in revenue indicates increased economic activity, which can lead to higher government spending on essential sectors like infrastructure, healthcare, and education, stimulating overall economic growth.

3. What are the implications of the government’s spending priorities?

- The government’s spending priorities reflect its focus areas and policy direction. Understanding these priorities is crucial as they influence resource allocation, economic development, and governance decisions.

4. How do fiscal dynamics impact taxation policies?

- Fiscal dynamics, including deficit levels and revenue trends, can influence taxation policies. Higher deficits may lead to increased taxes or changes in tax structures to generate additional revenue.

5. How does the fiscal update for 2023-24 relate to exam preparation?

- The fiscal update provides relevant current affairs knowledge essential for government exams, particularly in economics, governance, and public administration subjects.

Some Important Current Affairs Links