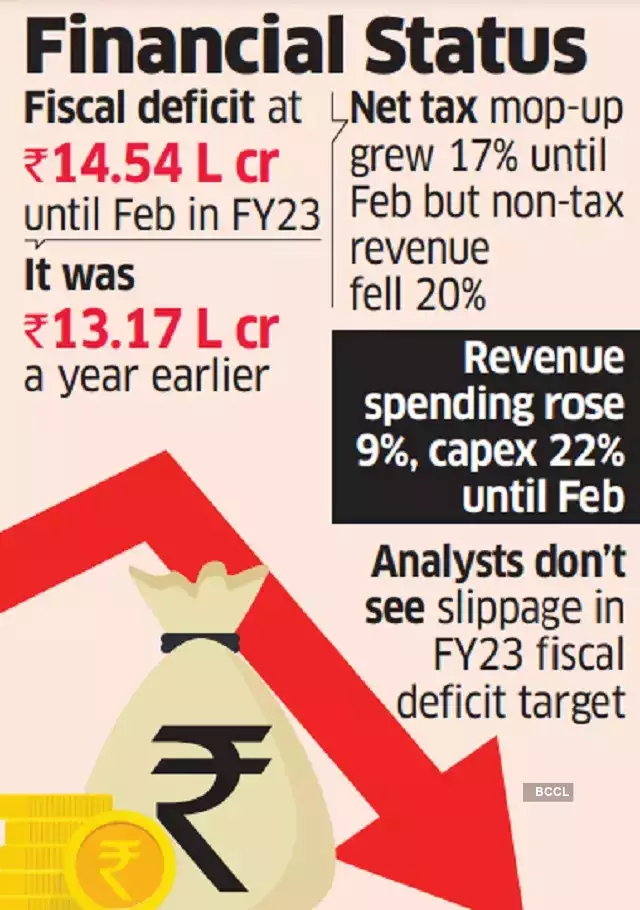

India fiscal deficit : India’s April-February Fiscal Deficit at Rs 14.54 Lakh Crore: 83% of FY23 Target

India’s fiscal deficit for the first eleven months of the fiscal year 2022-23 was Rs 14.54 lakh crore, which is equivalent to 83% of the target for the entire fiscal year, according to the data released by the Controller General of Accounts (CGA) on March 31. The government had set a target of Rs 17.65 lakh crore for the fiscal deficit in the current financial year. The deficit was at 76.7% of the target during the same period last year.

The fiscal deficit is the difference between the government’s total revenue and its total expenditure. In India, the fiscal year begins in April and ends in March. The government has been forced to increase its borrowing due to the COVID-19 pandemic, which has led to a fall in tax collections and an increase in spending.

Why this News is Important

The news of India’s fiscal deficit is important for students who are preparing for government exams for various positions, including teachers, police officers, banking, railways, defence, and civil service positions like PSCS to IAS. The fiscal deficit is a key indicator of the health of the country’s economy and is closely watched by investors and credit rating agencies. The news is also important for the general public as it affects the government’s ability to spend on important programs and infrastructure projects.

Historical Context

India’s fiscal deficit has been a cause of concern for many years. The government has been struggling to keep the fiscal deficit under control due to the rising expenditure on subsidies, social welfare programs, and infrastructure projects. The COVID-19 pandemic has added to the government’s woes as it has led to a fall in tax collections and an increase in spending on health care and social welfare programs. The government has been forced to increase its borrowing to meet its expenditure commitments.

5 Key Takeaways from “India’s April-February Fiscal Deficit at Rs 14.54 Lakh Crore: 83% of FY23 Target”

| Serial Number | Key Takeaway |

|---|---|

| 1. | India’s fiscal deficit for April-February 2022-23 was Rs 14.54 lakh crore. |

| 2. | The fiscal deficit is 83% of the target for the entire fiscal year. |

| 3. | The government had set a target of Rs 17.65 lakh crore for the fiscal deficit in the current financial year. |

| 4. | The fiscal deficit was at 76.7% of the target during the same period last year. |

| 5. | The COVID-19 pandemic has led to a fall in tax collections and an increase in spending, forcing the government to increase its borrowing. |

In conclusion, the news of India’s fiscal deficit for the first eleven months of the fiscal year 2022-23 is a cause for concern for the government and the general public. The government’s ability to spend on important programs and infrastructure projects will be affected if the fiscal deficit continues to rise. Students who are preparing for government exams should be aware of the fiscal deficit and its impact on the economy and the government’s ability to spend.

Important FAQs for Students from this News

Q1. What is fiscal deficit?

A1. Fiscal deficit is the difference between the government’s total revenue and its total expenditure.

Q2. Why is India’s fiscal deficit a cause for concern?

A2. India’s fiscal deficit is a cause for concern as it affects the government’s ability to spend on important programs and infrastructure projects.

Q3. How has the COVID-19 pandemic affected India’s fiscal deficit?

A3. The COVID-19 pandemic has led to a fall in tax collections and an increase in spending on health care and social welfare programs, forcing the government to increase its borrowing to meet its expenditure commitments.

Q4. What is the target for India’s fiscal deficit in the current financial year?

A4. The government has set a target of Rs 17.65 lakh crore for the fiscal deficit in the current financial year.

Q5. What is the difference between the fiscal year and the calendar year?

A5. The fiscal year is the year in which the government calculates its budget and runs its finances, while the calendar year is the year as per the Gregorian calendar.

Some Important Current Affairs Links