“Understanding CGST – Central Goods and Services Tax”

The introduction of the Goods and Services Tax (GST) marked a significant shift in India’s taxation system. This comprehensive tax reform aimed to streamline the tax structure, making it more efficient and less complex. Among the various components of GST, CGST or Central Goods and Services Tax holds a crucial place. In this article, we will delve into the details of CGST, its importance, historical context, and key takeaways that students preparing for government exams need to be aware of.

Why CGST is Important:

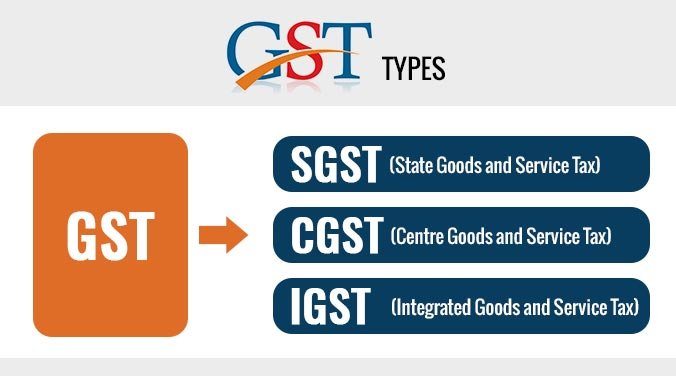

Understanding CGST: The Central Goods and Services Tax (CGST) is a significant component of the Goods and Services Tax (GST) regime in India. It is one of the three taxes, the other two being SGST (State Goods and Services Tax) and IGST (Integrated Goods and Services Tax), that collectively replaced the complex indirect tax structure. CGST is levied on intra-state transactions, i.e., transactions that occur within a state.

Simplifying Taxation: The introduction of CGST, along with other GST components, aimed to simplify taxation in India. It eliminated the cascading effect of taxes, where taxes were levied on taxes, making it a more transparent and efficient system. With the implementation of CGST, taxpayers deal with a single tax structure, making compliance easier.

Historical Context:

Before the implementation of GST, India had a complex and multi-tiered tax system. Various central and state taxes, such as excise duty, service tax, and value-added tax (VAT), coexisted. This created a web of taxes and increased the tax burden on businesses. In 2017, India adopted the GST regime, unifying taxes across the country. This reform aimed to eliminate the challenges posed by the earlier tax structure and bring about a more efficient tax system.

Key Takeaways from “Understanding CGST”:

| Serial Number | Key Takeaway |

|---|---|

| 1 | CGST is a crucial component of the Goods and Services Tax system in India. |

| 2 | It is levied on intra-state transactions. |

| 3 | CGST simplifies the taxation system, making it more transparent and efficient. |

| 4 | The historical context involves the elimination of the complex multi-tiered tax structure in 2017. |

| 5 | CGST has contributed to economic growth and improved ease of doing business in India. |

Important FAQs for Students from this News

Q: What is CGST?

A: CGST stands for Central Goods and Services Tax. It is one of the taxes in the Goods and Services Tax (GST) system in India, levied on intra-state transactions.

Q: How is CGST different from SGST?

A: CGST is collected by the central government on intra-state transactions, while SGST is collected by the state government. The two together make up the total GST on such transactions.

Q: What was the purpose of introducing GST in India?

A: The introduction of GST aimed to simplify India’s complex tax structure, eliminate the cascading effect of taxes, and make taxation more efficient.

Q: Can you provide an example of an intra-state transaction?

A: An example of an intra-state transaction subject to CGST would be a product being sold from one location within a state to another location within the same state.

Q: How has GST impacted the Indian economy?

A: GST has contributed to economic growth, improved ease of doing business, and increased tax compliance in India.

Some Important Current Affairs Links