What Are Tariffs?

Tariffs are taxes or duties imposed by a government on imported goods and services. These are used to control trade between countries, protect domestic industries, and generate revenue for the government. Tariffs are typically calculated as a percentage of the product’s total cost, including freight and insurance.

🎯 Why Do Countries Use Tariffs?

Countries use tariffs for several reasons:

- Protecting domestic industries: Tariffs make imported goods more expensive, encouraging consumers to buy locally produced items.

- Revenue generation: In many developing nations, tariffs are a major source of income for the government.

- Trade negotiations: Tariffs can be used as bargaining tools during international trade deals or to retaliate against unfair practices.

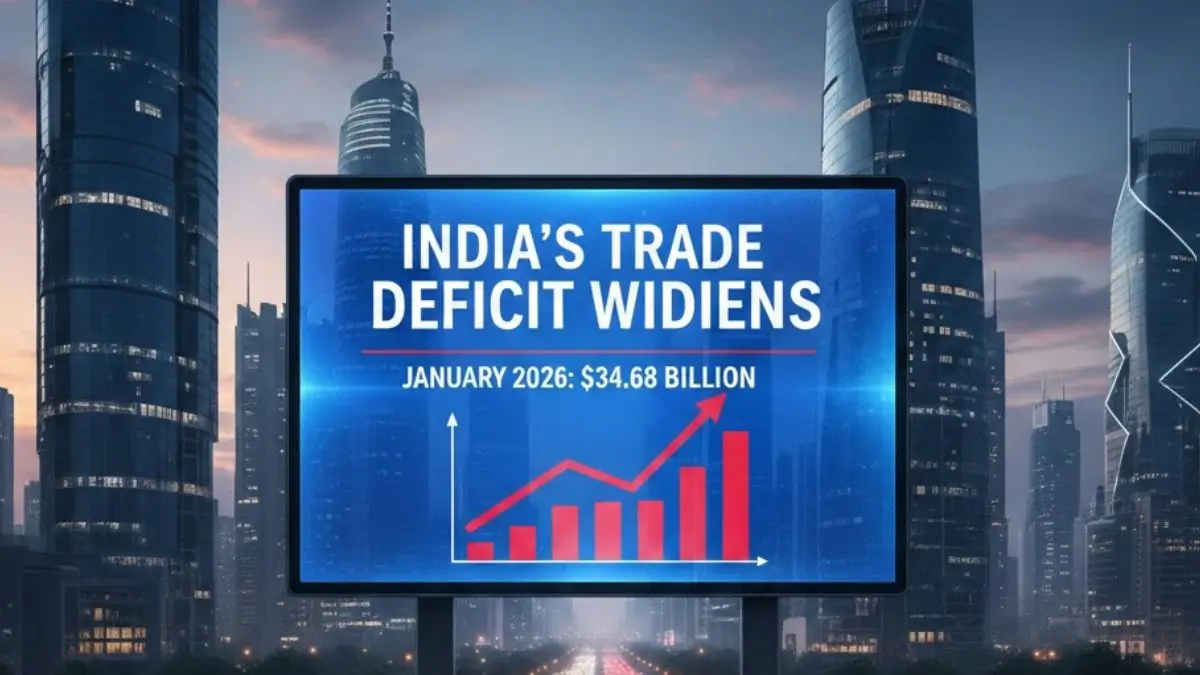

- Correcting trade imbalances: Countries may impose tariffs to reduce reliance on imports and improve their trade deficit.

💸 Who Pays the Tariff?

Although tariffs are levied on importers, the cost is usually passed on to consumers in the form of higher prices. Businesses importing goods either absorb the extra cost or increase product prices, affecting market demand and consumer behavior. Sometimes, the exporting country may lower its prices to remain competitive.

🌍 Impact of Tariffs on Global Trade

Tariffs often lead to trade tensions and retaliatory measures, disrupting international economic relations. For example, the U.S.–China trade war significantly impacted global supply chains and market stability. High tariffs can reduce trade volume, hamper economic growth, and discourage foreign investments.

📉 Tariffs in the Indian Context

India uses tariffs strategically to promote local industries under the “Atmanirbhar Bharat” initiative. By increasing import duties on electronics, furniture, and other goods, the government encourages local manufacturing. However, excessive tariffs can lead to inflationary pressures and reduce consumer choices.

🔍 Why This News Is Important

🌐 Understanding Economic Tools

For aspirants of competitive exams, understanding tariffs is essential to grasp key concepts of international trade, taxation, and economic policy. Tariffs are frequently asked about in questions related to international relations, economy, and government schemes.

🧠 Relevance in Current Affairs

Tariffs have been central to major economic policies worldwide, especially in the context of trade wars and India’s evolving import-export dynamics. As India navigates global supply chains and domestic growth, tariff policy is a crucial element of self-reliance.

🕰️ Historical Context of Tariffs

The use of tariffs dates back centuries when governments levied taxes on goods crossing borders to build revenues. In modern history, the Smoot-Hawley Tariff Act (1930) in the U.S. worsened the Great Depression by triggering a global decline in trade. Over time, global trade institutions like the World Trade Organization (WTO) have pushed for tariff reduction to boost free trade. However, protectionism has resurged in recent years with countries reevaluating their economic priorities post-COVID and amid geopolitical tensions.

📌 Key Takeaways from “Tariffs and Their Global Impact”

| S.No. | Key Takeaway |

|---|---|

| 1 | Tariffs are taxes imposed on imported goods, primarily to protect local industries. |

| 2 | They are used to generate government revenue, correct trade imbalances, and retaliate. |

| 3 | Consumers usually bear the brunt of tariffs through increased product prices. |

| 4 | Excessive tariffs can trigger trade wars and disrupt global supply chains. |

| 5 | India uses tariffs strategically under Atmanirbhar Bharat to promote domestic production. |

FAQs: Frequently Asked Questions on Tariffs

1. What is a tariff?

A tariff is a tax or duty imposed by a government on goods and services imported from other countries.

2. Why do countries impose tariffs?

Tariffs are imposed to protect domestic industries, generate government revenue, reduce trade imbalances, and for political or strategic reasons during trade negotiations.

3. Who pays the tariff—the exporter or the importer?

Tariffs are paid by importers, but the cost is often passed on to consumers in the form of higher product prices.

4. How do tariffs impact the economy?

Tariffs can protect local industries and generate revenue but can also lead to inflation, reduced international trade, and trade wars.

5. What is the role of tariffs in India’s Atmanirbhar Bharat mission?

India uses tariffs to reduce dependence on imports and encourage local manufacturing, thus boosting economic self-reliance.

Some Important Current Affairs Links