GST Revenues in India Hit Record High in April at ₹1.87 Lakh Crore

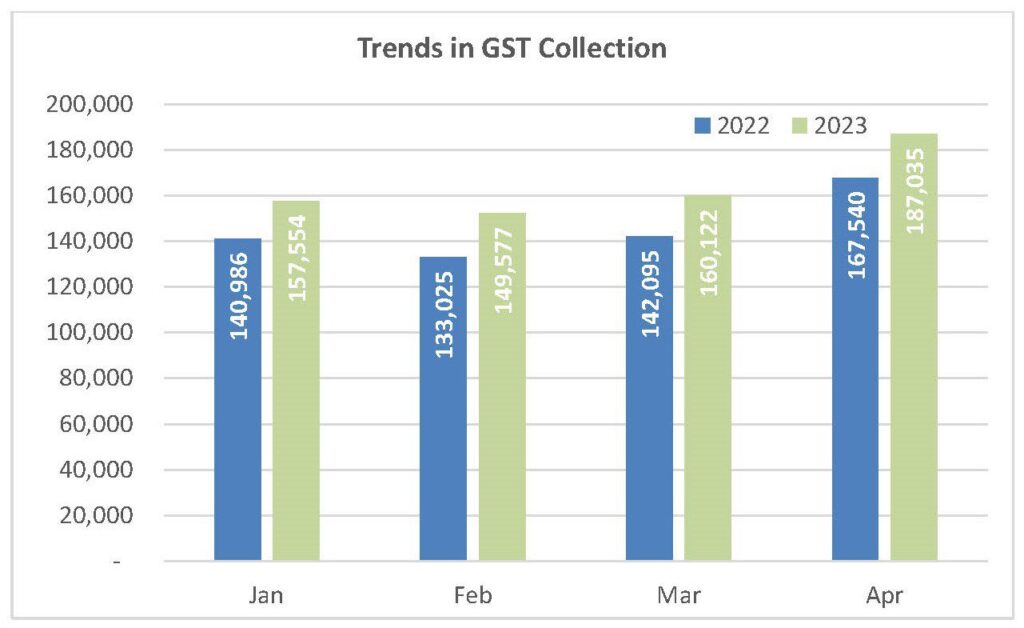

In a piece of great news for the Indian economy, the Goods and Services Tax (GST) revenues for April 2023 touched a record high of ₹1.87 lakh crore. This revenue collection surpassed the previous month’s figure of ₹1.41 lakh crore by a staggering 32.62%. This increase in GST collection can be attributed to various factors such as increased compliance, a growing economy, and the government’s efforts to widen the tax base.

The GST regime was introduced in India in 2017 to create a uniform tax structure across the country. It replaced the complex system of indirect taxes and brought all goods and services under a single tax system. GST is levied at every stage of the supply chain, from manufacturer to consumer, and is collected by the Central and State governments.

Why this News is important

Record high GST revenues for April 2023 are an indicator of the country’s economic growth. The increase in revenue collection is a positive sign for the government, as it will provide more funds for developmental projects. GST revenues are an essential source of revenue for the government, and their increase will help in bridging the fiscal deficit.

Moreover, this news is crucial for students preparing for government exams for various positions like teachers, police officers, banking, railways, defense, and civil service positions like PSCS to IAS. The topic of GST and its impact on the economy is a frequently asked topic in these exams. Therefore, understanding the latest developments in GST is crucial for the aspirants.

Historical context

The implementation of GST in India was a significant tax reform that aimed to bring a uniform tax structure across the country. The GST system replaced the complicated system of indirect taxes and brought all goods and services under one umbrella. The GST system has made tax collection more efficient and transparent, leading to higher revenue collections for the government.

Since its implementation, GST collections have seen a steady increase, with the highest monthly collection being ₹1.41 lakh crore in March 2023. The GST Council has been making continuous efforts to improve the GST system and increase compliance, which has resulted in the record high collection in April 2023.

5 Key Takeaways from “GST Revenues in India Hit Record High in April at ₹1.87 Lakh Crore”

| Serial Number | Key Takeaway |

|---|---|

| 1. | The Goods and Services Tax (GST) revenues for April 2023 touched a record high of ₹1.87 lakh crore. |

| 2. | This revenue collection surpassed the previous month’s figure of ₹1.41 lakh crore by a staggering 32.62%. |

| 3. | The increase in GST collection can be attributed to various factors such as increased compliance, a growing economy, and the government’s efforts to widen the tax base. |

| 4. | GST revenues are an essential source of revenue for the government, and their increase will help in bridging the fiscal deficit. |

| 5. | Understanding the latest developments in GST is crucial for students preparing for government exams for various positions like teachers, police officers, banking, railways, defense, and civil service positions like PSCS to IAS. |

I hope this article and key takeaways will be helpful to the aspirants preparing for government exams and provide them with a better understanding of the latest developments in the Indian economy.

Important FAQs for Students from this News

Q: What is GST?

A: GST stands for Goods and Services Tax, which is a comprehensive indirect tax levied on the manufacture, sale, and consumption of goods and services in India.

Q: What is the current GST rate in India?

A: The current GST rate in India varies depending on the type of goods or services. There are four main tax slabs- 5%, 12%, 18%, and 28%.

Q: What is the significance of the record high GST revenues in April 2023?

A: The record high GST revenues in April 2023 indicate a growing economy and increased tax compliance. This could also have a positive impact on the government’s ability to fund public services and infrastructure.

Q: How does GST impact various sectors of the Indian economy?

A: GST has a significant impact on various sectors of the Indian economy, such as manufacturing, services, and exports. It has simplified the tax structure and reduced tax evasion, leading to increased transparency and efficiency.

Q: How can students prepare for questions related to GST in their government exams?

A: Students can prepare for questions related to GST by studying the basics of the tax structure, understanding the different tax slabs, and keeping up with current affairs related to GST revenues and policies.

Some Important Current Affairs Links