India’s Fiscal Deficit Reaches 36% of FY Target in August

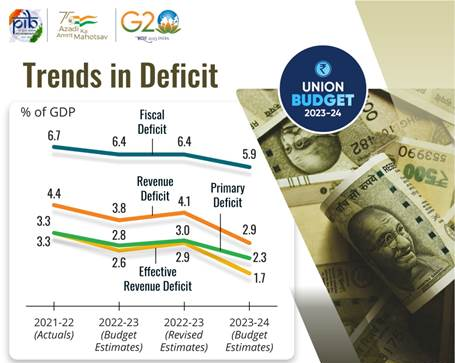

India, like many nations, grapples with the challenge of managing its fiscal health while striving for economic growth and development. In the pursuit of striking a balance, the country closely monitors its fiscal deficit, a key economic indicator reflecting the gap between government spending and revenue. Recent data indicates that India’s fiscal deficit has already reached 36% of the targeted amount for the fiscal year in August, signaling potential implications for the nation’s economic trajectory.

Why this News is Important

The fiscal deficit is a critical parameter that reflects the government’s financial health and its ability to meet its expenditure commitments. When the fiscal deficit grows rapidly or exceeds projected levels, it can raise concerns about economic stability. This news holds immense importance for students preparing for various government exams, particularly those aiming for positions in the finance sector or civil services. Understanding fiscal policies and their impact on the economy is a fundamental aspect of their exam preparation.

The fiscal deficit reaching 36% of the annual target in just a few months underscores the urgency of effective fiscal management. It necessitates a deeper understanding of fiscal policies, economic repercussions, and the government’s strategies to manage this situation effectively.

Historical Context

To comprehend the gravity of the current fiscal deficit, a historical perspective is vital. Over the years, India has grappled with fiscal challenges owing to a range of factors such as economic downturns, policy decisions, global economic shifts, and major events like wars and pandemics. Post-independence, India’s fiscal policies have evolved to address diverse economic scenarios and ensure stability. Understanding these historical contexts is crucial for a comprehensive grasp of fiscal management.

Key Takeaways from “India’s Fiscal Deficit Reaches 36% of FY Target in August”

| Serial Number | Key Takeaway |

|---|---|

| 1. | India’s fiscal deficit has already reached 36% of the targeted amount for the fiscal year in August, indicating potential fiscal challenges. |

| 2. | Fiscal deficit is a key indicator of a government’s fiscal health, reflecting the gap between its total expenditure and total revenue. |

| 3. | Effective fiscal management is crucial to ensure economic stability and sustainable development. |

| 4. | Historical context reveals the evolution of India’s fiscal policies, shaped by various economic, political, and global factors. |

| 5. | Understanding fiscal policies and their historical context is essential for students preparing for government exams, especially those related to finance and civil services. |

Important FAQs for Students from this News

Q1: What is fiscal deficit, and why is it significant in India’s economic context?

A1: Fiscal deficit represents the difference between a government’s total expenditure and total revenue. In India, it holds significance as it reflects the government’s financial health and its capacity to meet expenditure commitments. It’s a key indicator for economic stability.

Q2: Why is it concerning that India’s fiscal deficit reached 36% of the annual target in August?

A2: It’s concerning because such a rapid accumulation of fiscal deficit can strain the government’s finances and may lead to inflation, increased borrowing, and reduced funds for developmental projects.

Q3: How can students preparing for government exams benefit from understanding fiscal deficit?

A3: Understanding fiscal deficit is crucial for exams related to finance and civil services as it demonstrates knowledge of economic indicators, fiscal policies, and their historical context.

Q4: What factors contribute to fluctuations in India’s fiscal deficit over the years?

A4: Several factors, including economic downturns, policy decisions, global economic shifts, and major events like wars and pandemics, can influence India’s fiscal deficit.

Q5: How can India effectively manage its fiscal deficit to ensure economic stability?

A5: Effective fiscal management involves a balanced approach, including revenue generation, expenditure control, and strategic borrowing. It requires careful planning and execution of fiscal policies.

Some Important Current Affairs Links