Kotak Mahindra Mutual Fund Launches BSE PSU Index Fund

Kotak Mahindra Mutual Fund has introduced a new investment opportunity with the launch of the BSE PSU Index Fund. This fund aims to capitalize on the potential of Public Sector Undertakings (PSUs) listed on the Bombay Stock Exchange (BSE), offering investors a strategic avenue to diversify their portfolios into government-backed enterprises.

The BSE PSU Index Fund will track the performance of select PSU stocks listed on the BSE, providing investors with exposure to a basket of stocks known for their stability and growth potential in India’s economic landscape. This move by Kotak Mahindra Mutual Fund is aimed at catering to investors looking for long-term growth prospects with relatively lower volatility, typical of PSU stocks.

Why this News is Important:

Enhancing Investment Options for Stability and Growth

The launch of Kotak Mahindra Mutual Fund’s BSE PSU Index Fund holds significant importance for investors seeking stable investment avenues amidst market fluctuations. By focusing on PSU stocks listed on the BSE, the fund offers a strategic tool for diversification, potentially reducing risk while aiming for sustainable returns.

Promoting Inclusion of PSU Stocks in Investment Portfolios

With this launch, Kotak Mahindra Mutual Fund underscores the value of including PSU stocks in investment portfolios. PSUs are often perceived as pillars of stability due to government backing, making them attractive for conservative investors looking for steady growth opportunities.

Historical Context:

Evolution of PSU Investments in India

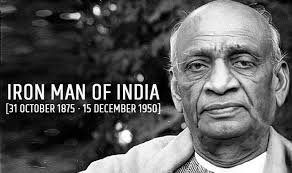

Public Sector Undertakings (PSUs) have been pivotal in India’s economic development since independence. Initially established to spearhead key sectors like energy, infrastructure, and finance, PSUs have evolved into major players contributing significantly to the nation’s GDP.

Key Takeaways from “Kotak Mahindra Mutual Fund Launches BSE PSU Index Fund”:

| Serial Number | Key Takeaway |

|---|---|

| 1. | The BSE PSU Index Fund by Kotak Mahindra Mutual Fund focuses on PSU stocks listed on the BSE. |

| 2. | Investors can diversify their portfolios with government-backed enterprises known for stability. |

| 3. | This fund aims to provide long-term growth potential with relatively lower volatility. |

| 4. | It underscores the importance of including PSU stocks in investment strategies for stability and growth. |

| 5. | The launch reflects Kotak Mahindra Mutual Fund’s strategy to cater to diverse investor needs in India. |

Important FAQs for Students from this News

What is the BSE PSU Index Fund launched by Kotak Mahindra Mutual Fund?

- The BSE PSU Index Fund is a new mutual fund launched by Kotak Mahindra Mutual Fund that tracks the performance of select Public Sector Undertaking (PSU) stocks listed on the Bombay Stock Exchange (BSE).

Who should consider investing in the BSE PSU Index Fund?

- Investors looking for exposure to government-backed PSU stocks with potential for stable returns and lower volatility may consider investing in this fund.

What are the benefits of investing in PSU stocks through this fund?

- Investing in the BSE PSU Index Fund offers diversification benefits by including a basket of PSU stocks known for their stability and growth potential in India’s economic landscape.

How does the BSE PSU Index Fund contribute to portfolio diversification?

- By including PSU stocks, which are backed by the government, the fund helps investors balance their portfolios with assets that may perform differently from traditional equity investments.

What is the historical performance of PSU stocks in India?

- PSU stocks have historically provided stability and dividends due to government support and their strategic importance in critical sectors like energy, infrastructure, and finance.

Some Important Current Affairs Links