Paytm Payments Bank Gets RBI Nod for Surinder Chawla as New CEO

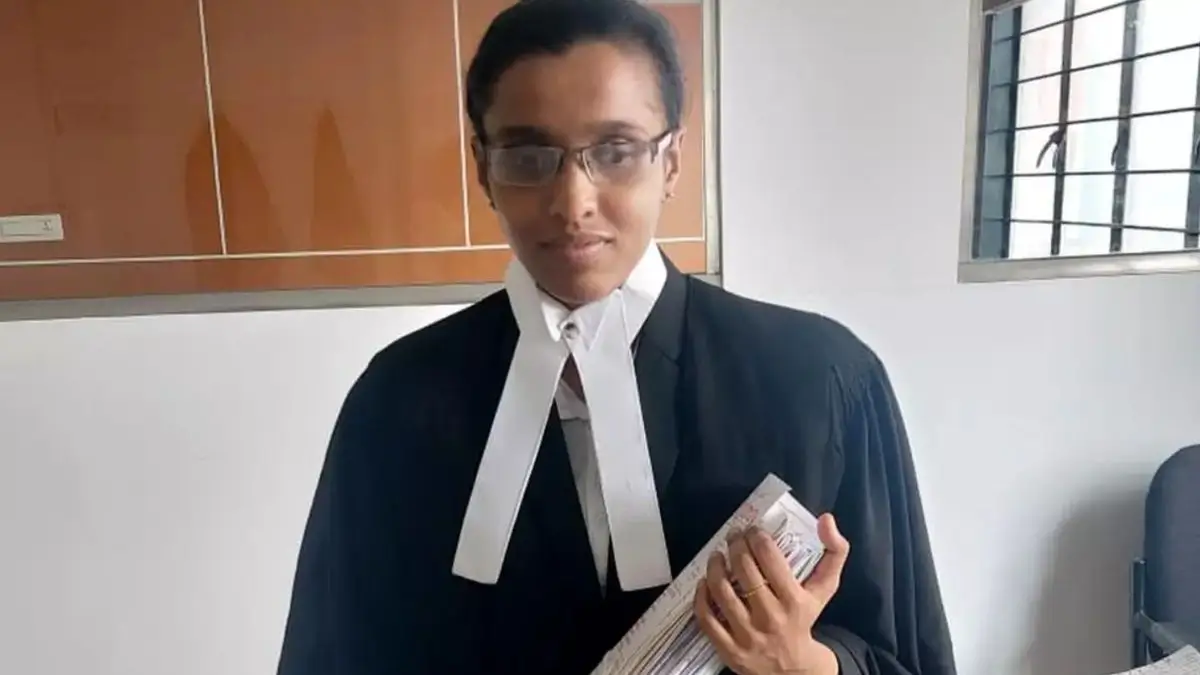

Paytm Payments Bank Limited (PPBL) has received approval from the Reserve Bank of India (RBI) for the appointment of Surinder Chawla as the new CEO of the bank. Surinder Chawla, who was earlier the Chief Business Officer (CBO) of PPBL, will replace Satish Kumar Gupta as the CEO of the bank.

This news is crucial for students preparing for government exams, such as banking and finance. The appointment of a new CEO of Paytm Payments Bank can be a significant topic of discussion in upcoming exams like the IBPS PO, SBI PO, RBI Grade B, and other banking exams.

Why this News is important

Paytm Payments Bank Limited (PPBL) has received approval from the Reserve Bank of India (RBI) for the appointment of Surinder Chawla as the new CEO of the bank. Surinder Chawla has been associated with Paytm since 2016 and has been instrumental in driving the growth of the bank’s business operations. This news is crucial for students preparing for government exams, such as banking and finance.

- Approval of Surinder Chawla as CEO: With the appointment of Surinder Chawla as the CEO of Paytm Payments Bank, students preparing for banking exams should know about the approval process of CEO by the Reserve Bank of India.

- Role of Paytm Payments Bank: The news highlights the importance of Paytm Payments Bank in the Indian banking sector and its contribution to financial inclusion.

- Leadership qualities required in banking: The appointment of a new CEO emphasizes the importance of leadership qualities required in the banking sector.

Historical context

Paytm Payments Bank Limited (PPBL) was launched in 2017 as a digital-only bank. The bank was set up with the aim of providing financial services to the underserved and unserved population of India. In November 2016, the bank was granted a license by the Reserve Bank of India to operate as a payments bank.

Paytm Payments Bank has been at the forefront of providing digital banking services to its customers. The bank has over 58 million savings accounts, and its customers can avail of services like digital debit cards, mobile banking, and online fund transfer.

Key Takeaways from “Paytm Bank Gets RBI Nod for Surinder Chawla as New CEO”

| S.no | Key Takeaways |

|---|---|

| 1. | Paytm Payments Bank has received approval from RBI for Surinder Chawla as its new CEO. |

| 2. | Surinder Chawla was earlier the CBO of PPBL. |

| 3. | The appointment of a new CEO emphasizes the importance of leadership qualities in the banking sector. |

| 4. | Paytm Payments Bank has over 58 million savings accounts. |

| 5. | The news highlights the importance of Paytm Payments Bank in the Indian banking sector and its contribution to financial inclusion. |

Conclusion

In conclusion, the appointment of Surinder Chawla as the new CEO of Paytm Payments Bank is a significant development in the Indian banking sector. It highlights the importance of leadership qualities required in the banking sector and reflects the bank’s confidence in his leadership abilities and vision. The news is crucial for students preparing for government exams like banking and finance, as it highlights the approval process of a CEO by the Reserve Bank of India and the importance of innovative products and services, user-friendly interface, and customer-centric approach in the banking sector.

Important FAQs for Students from this News

Q. What is Paytm Payments Bank Limited (PPBL)?

A. Paytm Payments Bank is a digital-only bank that was launched in 2017. The bank was set up with the aim of providing financial services to the underserved and unserved population of India.

Q. Who is Surinder Chawla and what is his role in Paytm Payments Bank?

A. Surinder Chawla is the newly appointed CEO of Paytm Payments Bank. He has been associated with Paytm since 2016 and was earlier the Chief Business Officer (CBO) of PPBL.

Q. When was Paytm Payments Bank granted a license by the Reserve Bank of India?

A. Paytm Payments Bank was granted a license by the Reserve Bank of India in November 2016 to operate as a payments bank.

Q. What services does Paytm Payments Bank offer?

A. Paytm Payments Bank offers services like digital debit cards, mobile banking, and online fund transfer.

Q. What is the tie-up between Paytm Payments Bank and Paytm?

A. Paytm Payments Bank has a tie-up with Paytm, India’s leading digital wallet and e-commerce platform, which has helped it leverage Paytm’s vast customer base and reach.

Some Important Current Affairs Links