Union Budget 2026 key highlights: ₹12.2 lakh crore capital expenditure, high-speed rail corridors, India Semiconductor Mission 2.0, tax reforms, and social sector allocations explained for exams.

Union Budget 2026: Major Announcements and Key Highlights

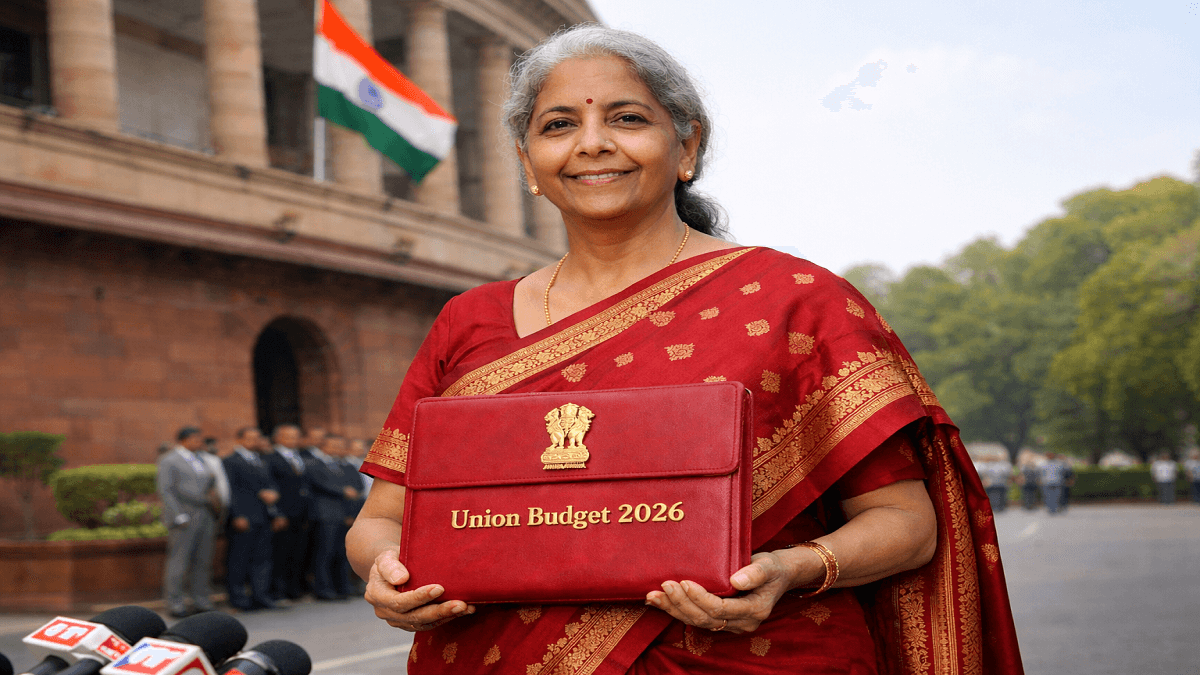

The Union Budget 2026‑27 was presented in the Parliament by Finance Minister Nirmala Sitharaman on 1st February 2026, marking her ninth consecutive Budget speech. This year’s budget focuses on sustainable economic growth, enhanced infrastructure spending, strategic manufacturing incentives, and tax reforms aimed at boosting growth and creating job opportunities.

Accelerating Economic Growth: Core Priorities

At the heart of Budget 2026 is the government’s commitment to accelerating India’s economic growth while maintaining fiscal discipline. The capital expenditure has been raised to ₹12.2 lakh crore, reflecting a substantial push towards infrastructure creation, logistics modernization, and urban development — essential for broad‑based economic expansion.

This emphasis on capital outlay is expected to generate employment, improve connectivity, and strengthen public assets. Additionally, schemes aimed at small and medium enterprises (MSMEs), services, and industry clusters are designed to promote widespread entrepreneurship and economic participation across sectors.

Infrastructure and Connectivity Boost

Infrastructure development remains a key pillar of Budget 2026. The government has announced the development of seven new high‑speed rail corridors, including routes such as Mumbai–Pune, Pune–Hyderabad, Hyderabad–Bengaluru, and Delhi–Varanasi. These corridors aim to transform intercity travel, reduce journey times, and enhance regional connectivity.

In addition, the Budget proposes a new dedicated freight corridor connecting Dankuni (West Bengal) to Surat (Gujarat). This freight network is expected to strengthen cargo movement efficiency, reduce logistics costs, and support industrial expansion across key economic regions.

Strategic Manufacturing Initiatives

Budget 2026 reaffirmed the government’s ‘Atmanirbhar Bharat’ vision through an expanded push for domestic manufacturing. A major focus is the launch of the India Semiconductor Mission 2.0, aimed at building capacities in chip production, research, design, and training. This move seeks to reduce dependence on imports and position India as a key player in global technology value chains.

Other significant manufacturing incentives include schemes for electronics component production, biopharma, rare earth permanent magnet manufacturing, chemical parks, and container manufacturing — all designed to strengthen industrial clusters and increase exports.

Tax Reforms and Ease of Compliance

The 2026 Budget introduced several tax reforms to simplify compliance and reduce burdens on taxpayers. Notable changes include rationalizing TCS (Tax Collected at Source) under the Liberalised Remittance Scheme (LRS), lowering rates on overseas education and medical remittances, and extending timelines for filing and revising income tax returns.

These reforms aim to enhance ease of living for individuals and create a more investor‑friendly tax environment, especially for small businesses and the middle class.

Sectoral Allocations and Social Development

Budget 2026 also laid emphasis on inclusive sectoral growth. Allocations for healthcare, education, AYUSH, and allied sectors are aimed at improving human capital and skill development. Strategic support for services such as medical value tourism, tertiary education hubs, allied health education, and youth sports development are expected to facilitate broader socio‑economic impact.

Why This News Is Important for Government Exam Aspirants

Relevance to Economy and Governance Syllabus

The Union Budget 2026 is a cornerstone topic in Indian Economy, Polity, and Governance sections of competitive exams like UPSC, SSC, Banking (IBPS, SBI), Railways, Defence and Police SI exams. Understanding the Budget helps students grasp macroeconomic policy, fiscal priorities, and government interventions — a frequent theme in both prelims and mains. Knowing budget highlights strengthens analytical answers in essays and GS papers.

Current Affairs and General Awareness

Budget announcements influence current affairs scoring sections in almost every government exam. Questions may range from flagship schemes, sector allocations (like defense and railways), to new policy initiatives like the India Semiconductor Mission 2.0. Familiarity with Budget 2026 helps aspirants anticipate likely developments in employment trends, tax reforms, infrastructure projects, and investment policies.

Application in Interview and Essay Stages

Budget themes often form the basis for essay topics or personal interview discussions — for example, infrastructure and balanced regional development or India’s strategy for technological self‑reliance. A comprehensive understanding shows deeper grasp of economic priorities, policy impact, and long‑term national planning.

For aspirants of defence and police exams, budget allocations for armed forces modernization provide insights into defence preparedness and strategic financial planning. Banking and railways aspirants benefit from knowledge on financial reforms and transport infrastructure planning.

Historical Context: Evolution of Union Budgets in India

From Post‑Independence Planning to Modern Economic Reforms

The Union Budget of India has been a pivotal instrument of economic policy since independence. Initially focused on post‑war reconstruction and public sector expansion, the Budget evolved significantly after 1991 liberalization, emphasizing market reforms, privatisation, and export‑oriented growth.

Shift Towards Capital Expenditure and Structural Reforms

In recent years, successive budgets have prioritized capital expenditure, aiming to build hard infrastructure like roads, rail networks, and urban connectivity — essential for economic acceleration. Budget 2026 continues this trend with record capital outlays for infrastructure and industry‑focused schemes.

Fiscal Prudence and Policy Innovation

While the role of the state in economic intervention remains substantial, recent budgets have also shown a commitment to fiscal consolidation, ensuring that deficit levels are controlled while public investment is maintained. This balance seeks to promote long‑term economic sustainability without compromising growth objectives.

Key Takeaways from Union Budget 2026

| S. No. | Key Takeaway |

|---|---|

| 1 | Capital expenditure increased to ₹12.2 lakh crore, emphasizing infrastructure growth. |

| 2 | Seven high‑speed rail corridors proposed for faster and greener connectivity. |

| 3 | Launch of India Semiconductor Mission 2.0 to boost domestic chip manufacturing. |

| 4 | Tax reforms include lower TCS under LRS and simpler compliance for taxpayers. |

| 5 | Strategic sector support expanded for MSMEs, healthcare, education, and services. |

FAQs: Frequently Asked Questions

1. What is the total capital expenditure announced in Union Budget 2026?

The government has announced ₹12.2 lakh crore as capital expenditure, primarily aimed at infrastructure, logistics, and industrial development.

2. Which high-speed rail corridors are planned under Budget 2026?

Seven corridors have been proposed, including Mumbai–Pune, Pune–Hyderabad, Hyderabad–Bengaluru, and Delhi–Varanasi, to improve connectivity and reduce travel time.

3. What is the India Semiconductor Mission 2.0?

It is an initiative to boost domestic chip manufacturing, design, and R&D, reducing India’s dependence on imports and supporting technology-led economic growth.

4. What are the major tax reforms announced in Budget 2026?

Key reforms include rationalizing TCS under the Liberalised Remittance Scheme (LRS), reducing compliance burdens, and extending timelines for filing income tax returns.

5. How does Budget 2026 support social and educational sectors?

The budget allocates funds for healthcare, education, AYUSH, youth skill development, and medical value tourism, aiming to enhance human capital and employment opportunities.

6. Why is Union Budget 2026 important for competitive exams?

It is crucial for exams like UPSC, SSC, Banking, Railways, and Defence because it covers economic policy, flagship schemes, infrastructure, tax reforms, and sectoral allocations, frequently asked in current affairs and general awareness sections.

7. What are the strategic sectors receiving special incentives under Budget 2026?

Sectors include MSMEs, electronics, biopharma, rare earth magnet manufacturing, chemical parks, and container manufacturing to promote industrial growth and exports.

Some Important Current Affairs Links