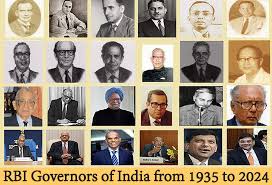

List of RBI Governors of India (1935 to 2023): Roles and Functions

Introduction to the RBI Governors

The Reserve Bank of India (RBI) is one of the most crucial financial institutions in the country. Established in 1935, the RBI is responsible for managing India’s monetary policy, controlling inflation, and fostering economic growth. The head of the RBI, known as the Governor, plays an integral role in shaping the financial landscape of India. Over the years, several eminent personalities have served as the Governor of the RBI, and each has made significant contributions to the country’s economic development.

List of RBI Governors from 1935 to 2023

The RBI has seen a series of distinguished governors since its inception. The first governor, Sir Osborne Smith, took office in 1935. Subsequently, several prominent figures took on the role, including C.D. Deshmukh, who was the first Indian to hold the position, and Raghuram Rajan, who served as governor from 2013 to 2016. The latest addition to this list is Shaktikanta Das, who has been serving as the RBI Governor since 2018.

Each governor has left their mark on India’s economy by implementing reforms, managing financial crises, and navigating the complexities of the global economic environment. From dealing with inflationary pressures to ensuring the stability of the banking sector, the role of the RBI Governor is both critical and challenging.

Roles and Functions of the RBI Governor

The primary function of the RBI Governor is to oversee the functioning of the Reserve Bank of India. This includes setting monetary policy, regulating and supervising the financial system, managing inflation, and ensuring economic growth. The Governor also acts as a key advisor to the Government of India on economic matters, representing the country in international financial forums, and managing the country’s foreign exchange reserves.

The Governor is also responsible for issuing currency notes, controlling the money supply, and maintaining the stability of the Indian rupee. Furthermore, they oversee the functioning of commercial banks and non-banking financial companies, ensuring that they operate in a manner that supports the overall economic stability of the country.

Why this News is Important

Significance in India’s Financial System

The role of the RBI Governor is crucial to India’s economic and financial systems. The Governor is at the helm of monetary policy, a key tool for managing inflation, interest rates, and the overall economic stability of the country. The decisions made by the RBI Governor directly affect individuals, businesses, and the economy as a whole, making their leadership a critical component of India’s financial governance.

Impact on Students Preparing for Government Exams

For students preparing for various government exams, understanding the roles and history of RBI Governors is essential. This topic is frequently covered in exams related to banking, finance, and current affairs. A thorough understanding of the RBI’s functions, the governors’ roles, and the significant contributions made by each individual can aid students in answering questions related to economic policies, banking regulations, and India’s financial history.

Comprehending Historical Reforms and Policies

Each RBI Governor has played a pivotal role in steering India through various economic challenges, from global financial crises to domestic inflation. Students preparing for exams such as the Civil Services Examination or banking exams must be well-versed with the reforms and policies implemented by the RBI under different governors. This knowledge will help them gain insights into India’s economic trajectory and improve their exam performance.

Historical Context

Foundation of the RBI (1935)

The Reserve Bank of India was established in 1935 under the Reserve Bank of India Act, 1934, with the goal of regulating the country’s currency and credit system. The initial purpose of the RBI was to manage the monetary system and act as the banker to the Government of India, which was particularly important during the colonial period. Over time, the RBI has grown into a central institution responsible for the overall financial stability of India.

Post-Independence Role of the RBI

After India gained independence in 1947, the RBI’s role became even more significant. The bank’s governance was crucial in rebuilding the country’s financial system, managing inflation, and ensuring the stability of the Indian rupee. The leadership of the RBI has evolved through different phases, with governors focusing on different aspects of monetary policy, ranging from inflation control to fostering economic growth.

Reforms and Economic Changes under Various Governors

Several key reforms have been introduced by the RBI under different governors. For example, under the leadership of C.D. Deshmukh, the RBI played a major role in the post-independence economic reconstruction of India. Similarly, during the tenure of Raghuram Rajan, significant reforms were implemented to stabilize the banking sector and tackle issues such as non-performing assets (NPAs). These reforms have been integral in ensuring India’s robust financial system.

Key Takeaways from “List of RBI Governors of India (1935 to 2023): Roles and Functions”

| No. | Key Takeaway |

|---|---|

| 1 | The Reserve Bank of India was established in 1935 to regulate the country’s currency and credit system. |

| 2 | The RBI Governor is responsible for shaping India’s monetary policy, managing inflation, and overseeing economic growth. |

| 3 | C.D. Deshmukh was the first Indian to become the Governor of the RBI. |

| 4 | Notable RBI Governors, such as Raghuram Rajan, introduced reforms to stabilize the banking sector and control inflation. |

| 5 | The current RBI Governor, Shaktikanta Das, has been in office since 2018 and plays a vital role in the country’s economic policy. |

Important FAQs for Students from this News

Who was the first Governor of the Reserve Bank of India (RBI)?

- Answer: Sir Osborne Smith was the first Governor of the Reserve Bank of India (RBI), serving from 1935 to 1937.

What is the primary responsibility of the RBI Governor?

- Answer: The primary responsibility of the RBI Governor is to oversee India’s monetary policy, regulate the financial system, manage inflation, and ensure the economic stability of the country.

Who was the first Indian to serve as the Governor of the RBI?

- Answer: C.D. Deshmukh was the first Indian to serve as the Governor of the RBI, holding the position from 1943 to 1949.

What are some key reforms introduced by RBI Governors?

- Answer: RBI Governors have introduced various reforms, including measures to stabilize the banking sector, control inflation, and implement changes to the monetary policy framework, particularly under Raghuram Rajan and Shaktikanta Das.

Who is the current Governor of the RBI as of 2023?

- Answer: Shaktikanta Das is the current Governor of the RBI, having assumed office in December 2018.

Some Important Current Affairs Links