Major Provisions of RBI Act

Major Provisions of RBI Act

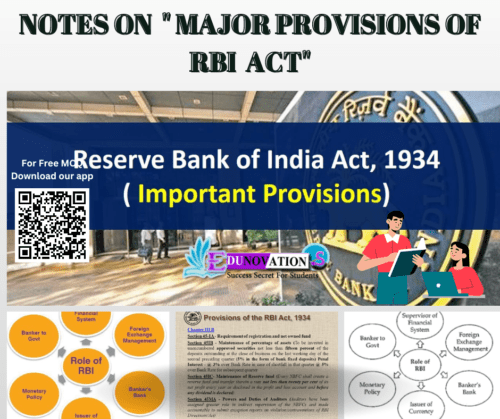

The RBI Act outlines the powers, functions and responsibilities of the Reserve Bank of India. The Act provides for the establishment of the Reserve Bank of India and defines its objective as “to regulate the issue of bank notes and keeping of reserves with a view to securing monetary stability in India and generally to operate the currency and credit system of the country to its advantage”.

The Act sets out the Reserve Bank’s functions which include:

1. Formulating, implementing and monitoring monetary policy

2. Regulating the banking system

3. Managing the country’s foreign exchange reserves

4. issuing currency

5. acting as a banker to the government

6. supervising and regulating the financial system

The Reserve Bank is also required to promote financial stability and to regulate and oversee payment systems.

The RBI Act gives the Reserve Bank a wide range of powers to carry out its functions.

These include the power to:

1. Issue directives to banks

2. Override the decisions of bank boards

3. Conduct inspections of banks

4. Impose penalties on banks and their directors

5. Require banks to disclose information

6. Issue currency

7. Manage the country’s foreign exchange reserves

8. Act as a banker to the government

9. Issue and redeem government securities

10. Lend to financial institutions

11. Provide financial assistance to banks in difficulty

12. Supersede the board of directors of a bank

The Reserve Bank is also authorised to take such measures as it considers necessary to discharge its functions and to exercise its powers under the Act.

The RBI Act provides for the establishment of a central board of directors to exercise general supervision over the affairs of the Reserve Bank. The board is required to meet at least four times a year. The board must consist of not less than seven and not more than seventeen members, as specified by the central government. The central government also appoints the Governor and Deputy Governors of the Reserve Bank.

The Governor is the chief executive officer of the Reserve Bank and is responsible for the general management of the affairs of the Reserve Bank. The Deputy Governors are appointed by the central government on the recommendation of the Governor.

The Act provides for the establishment of an audit committee to assist the central board in discharge of its functions relating to audit. The committee must consist of three members, one of whom must be a Chartered Accountant.

The RBI Act gives the central government the power to give directions to the Reserve Bank on matters of policy. The central government is required to consult the Reserve Bank on all major policy matters concerning the monetary system.

The Reserve Bank is required to undertake activities to promote financial inclusion. The Reserve Bank is also required to promote the use of technology for delivery of banking services.

10 important topics to study in “Major Provisions of RBI Act”.

1. The Reserve Bank of India Act, 1934 is the key legislation that governs the functioning of India’s central bank, the Reserve Bank of India (RBI).

2. The RBI is vested with the responsibility of regulate the country’s monetary policy and ensuring financial stability.

3. The RBI Act provides for the establishment of a Monetary Policy Committee (MPC) to advice on the formulation of monetary policy.

4. The RBI Act also provides for the establishment of a Deposit Insurance and Credit Guarantee Corporation (DICGC) to protect depositors’ interests and promote financial stability.

5. The RBI is authorised to issue currency notes and coins, regulate the banking sector and act as a banker to the government.

6. The RBI is also responsible for the supervision and regulation of financial institutions and for promoting financial inclusion.

7. The RBI Act provides for the establishment of a Prudential Regulation Authority (PRA) to promote the safety and soundness of the banking sector.

8. The RBI is required to maintain certain reserve ratios which serve as a buffer against macroeconomic shocks.

9. The RBI Act provides for the establishment of a Financial Stability and Development Council (FSDC) to monitor and address macro-prudential and financial sector issues.

10. The RBI is empowered to take a wide range of measures to ensure financial stability and promote economic growth.