NITI Aayog Trade Report 2026 reveals Q2 FY 2025–26 India export growth, electronics trade insights, and strategic policy recommendations. Essential for competitive exams.

NITI Aayog Releases Sixth Edition of ‘Trade Watch Quarterly’ (Q2 FY 2025–26)

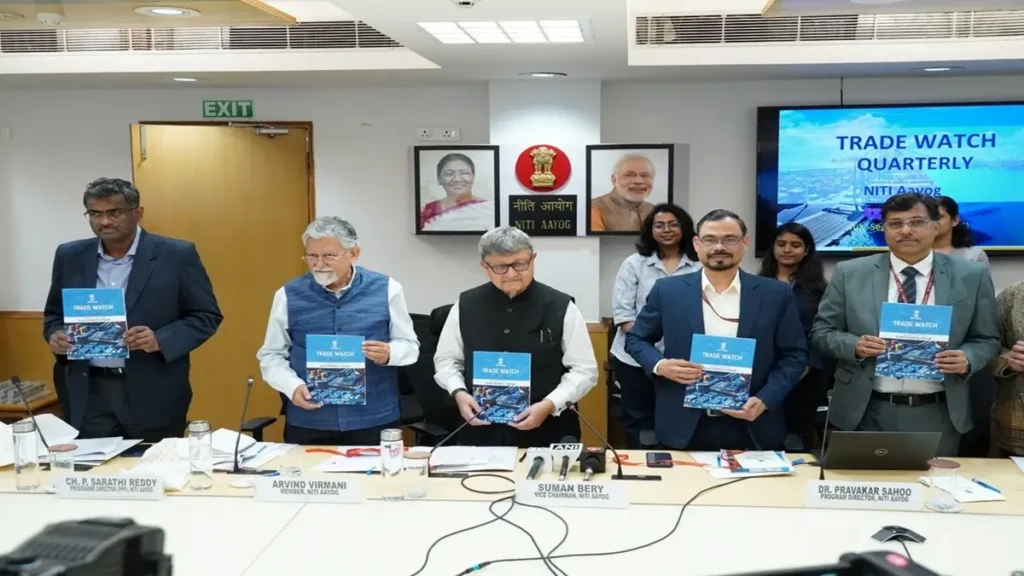

On 13th February 2026, the NITI Aayog unveiled the sixth edition of the Trade Watch Quarterly report for the second quarter of the financial year 2025–26 (July–September 2025) in New Delhi. The publication was formally released by Shri Suman Bery, Vice‑Chairman of NITI Aayog, in the presence of senior officials including Member Shri Arvind Virmani.

Comprehensive Assessment of India’s Trade Performance

The report provides a data‑driven analysis of both domestic and global trade dynamics during Q2 FY26. It offers an integrated snapshot of export and import trends, accompanied by insights into thematic sectors that influence India’s trade structure. Key metrics reveal that India’s overall exports (services + merchandise) grew by approximately 8.5% in Q2, outpacing import growth and demonstrating sustained trade resilience in an uncertain global environment.

Thematic Focus: Electronics Trade Emerges as Strategic Driver

A major highlight of this edition is the thematic emphasis on India’s electronics trade, portraying the sector as a rapidly growing and strategically critical component of the country’s export basket. Electronics exports rose substantially in recent years, showcasing a five‑fold increase between 2016 and 2024, reaching around USD 42 billion, and contributing significantly to India’s trade momentum. Despite this growth, India’s global share in electronics exports remains around 1%, indicating potential for further expansion.

Within this thematic focus, the report stresses the need for higher value addition through domestic production of components, such as chips, semiconductors, and advanced electronic parts, while moving beyond assembly‑centric exports.

Policy Support and Future Strategy

The Trade Watch Quarterly also outlines areas where policy support and industry strategy can bolster growth. For instance:

- Union Budget allocations — such as ₹40,000 crore under the Electronics Components Manufacturing Scheme — aim to enhance domestic capacity and reduce reliance on imports.

- Emphasis on deeper integration into global value chains (GVCs) to improve competitiveness and global presence.

- Identification of future growth areas like embedded systems, power electronics, and semiconductor assembly.

Export Destinations and Sectoral Insights

The report highlights key global destinations for India’s electronics exports, including the United States, United Kingdom, and the UAE, and highlights sectors like mobile phones, consumer electronics, and communication equipment as major export contributors.

Why This News Is Important

Relevance for Exam Aspirants

Understanding the release and content of the Trade Watch Quarterly is vital for students preparing for government exams like SSC, UPSC, Banking, Railways, Defence, and Teaching because:

- Economic Insight: The report provides real‑time data on India’s trade performance, export growth, and structural shifts. This information is directly relevant to economy and international trade sections of exams.

- Policy Awareness: NITI Aayog is India’s premier policy think tank, and its publications often reflect government priorities and future economic strategies — knowledge crucial for General Studies and current affairs.

- Sectoral Trends: The thematic focus on electronics trade highlights strategic economic sectors, making it a valuable addition to industry and business GK sections.

- Macro‑Economic Indicators: Key figures like export growth percentages help candidates answer questions on trade dynamics and economic performance.

- Global Integration Understanding: Insights into India’s global trade positioning enhance awareness of international relations and economic diplomacy, which are increasingly part of competitive exams.

Historical Context of Trade Watch Quarterly

The Trade Watch Quarterly is a flagship publication of NITI Aayog, launched to provide a regular and thematic analysis of India’s trade environment. The initiative began as part of India’s broader effort to institutionalize data‑backed economic reporting and support evidence‑based policymaking. Over successive quarters, the publication has covered varied themes — from automotive exports to structural shifts in services and manufacturing trade sectors.

The report’s evolution reflects the Indian government’s increasing emphasis on tracking not just aggregate trade figures but also the quality and composition of exports, integration into global value chains, and sectoral competitiveness. It has become an important reference for policymakers, economists, researchers, and exam aspirants who study India’s economic performance.

Key Takeaways from ‘Trade Watch Quarterly’ (Sixth Edition)

| S. No. | Key Takeaway |

|---|---|

| 1 | India’s exports (services + merchandise) grew by approximately 8.5% in Q2 FY 2025–26, indicating stronger trade momentum. |

| 2 | The sixth edition of Trade Watch Quarterly was released on 13 Feb 2026 by NITI Aayog. |

| 3 | Electronics trade emerged as a central thematic focus and is now the second‑largest export segment for India. |

| 4 | India’s electronics exports grew significantly (nearly fivefold between 2016 and 2024) but still hold ~1% global market share, showing growth potential. |

| 5 | The report underscores the need for value addition in electronics manufacturing, including components like chips and semiconductors, to sustain export growth. |

FAQs: Frequently Asked Questions

1. What is the Trade Watch Quarterly?

The Trade Watch Quarterly is a flagship publication by NITI Aayog that analyzes India’s trade performance, including exports, imports, and sectoral trends. It provides data-driven insights for policy formulation and economic strategy.

2. When was the sixth edition of Trade Watch Quarterly released?

The sixth edition was released on 13th February 2026, covering Q2 FY 2025–26 (July–September 2025).

3. Which sector was highlighted in the sixth edition?

The report focused on electronics trade, emphasizing its growth potential and strategic importance for India’s export basket.

4. How much did India’s exports grow in Q2 FY 2025–26?

India’s overall exports (merchandise + services) grew by approximately 8.5% during Q2 FY 2025–26.

5. Why is the Trade Watch Quarterly important for competitive exams?

It provides current economic data, policy insights, sectoral trends, and global trade positioning, all of which are relevant for exams like UPSC, SSC, Banking, Railways, Defence, and Teaching.

6. What are the key recommendations of the report?

The report recommends enhancing domestic value addition in electronics manufacturing, focusing on components like chips and semiconductors, and integrating into global value chains (GVCs) for sustainable export growth.

Some Important Current Affairs Links